Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Electrozink Open Joint-Stock Company (MCX:ELTZ) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Electrozink

What Is Electrozink's Net Debt?

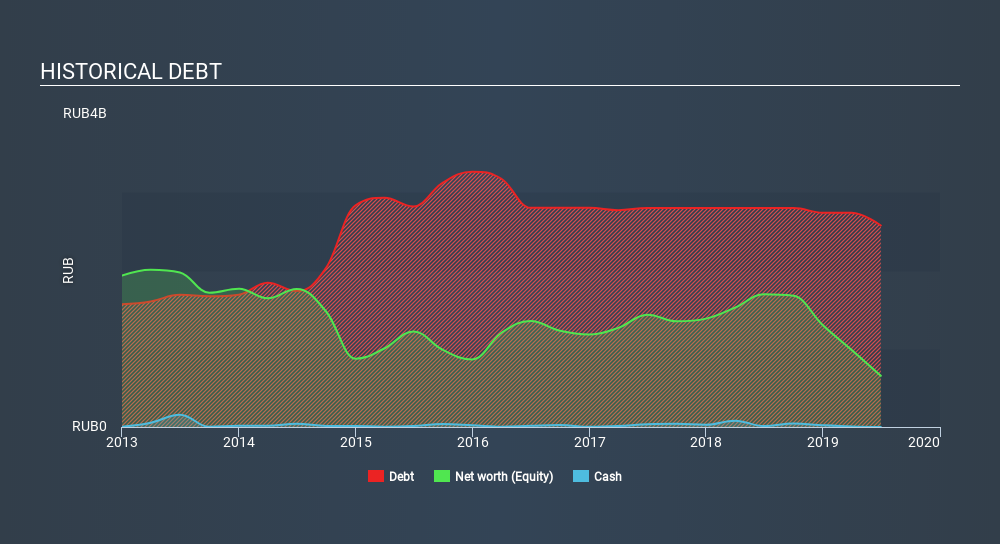

The image below, which you can click on for greater detail, shows that Electrozink had debt of ₽2.58b at the end of June 2019, a reduction from ₽2.80b over a year. Net debt is about the same, since the it doesn't have much cash.

A Look At Electrozink's Liabilities

The latest balance sheet data shows that Electrozink had liabilities of ₽3.65b due within a year, and liabilities of ₽76.9m falling due after that. Offsetting this, it had ₽1.56m in cash and ₽596.1m in receivables that were due within 12 months. So its liabilities total ₽3.13b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the ₽162.9m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Electrozink would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Electrozink will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Electrozink made a loss at the EBIT level, and saw its revenue drop to ₽2.2b, which is a fall of 58%. That makes us nervous, to say the least.

Caveat Emptor

While Electrozink's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable ₽1.6b at the EBIT level. When you combine this with the very significant balance sheet liabilities mentioned above, we are so wary of it that we are basically at a loss for the right words. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it lost ₽1.0b in the last year. So we think buying this stock is risky, like walking through a minefield with a mask on. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Electrozink's profit, revenue, and operating cashflow have changed over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About MISX:ELTZ

Electrozink

Electrozink Public Joint-Stock Company produces and sells various non-ferrous metallurgy products in Russia.

Good value with worrying balance sheet.

Market Insights

Community Narratives