Steve Hudson became the CEO of ECN Capital Corp. (TSE:ECN) in 2016. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Next, we'll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for ECN Capital

How Does Steve Hudson's Compensation Compare With Similar Sized Companies?

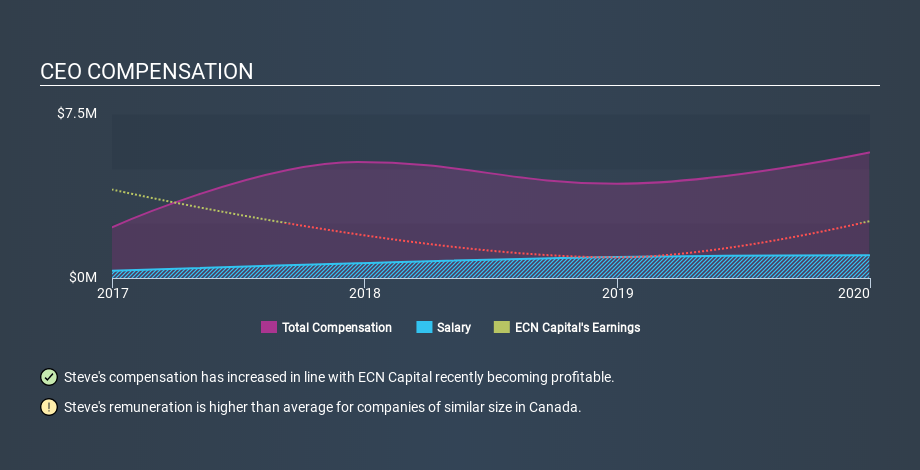

Our data indicates that ECN Capital Corp. is worth CA$838m, and total annual CEO compensation was reported as US$5.7m for the year to December 2019. That's a notable increase of 33% on last year. We think total compensation is more important but we note that the CEO salary is lower, at US$1.0m. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. When we examined a selection of companies with market caps ranging from US$200m to US$800m, we found the median CEO total compensation was US$1.2m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where ECN Capital stands. Talking in terms of the sector, salary represented approximately 65% of total compensation out of all the companies we analysed, while other remuneration made up 35% of the pie. Non-salary compensation represents a greater slice of the remuneration pie for ECN Capital, in sharp contrast to the overall sector.

It would therefore appear that ECN Capital Corp. pays Steve Hudson more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous. You can see a visual representation of the CEO compensation at ECN Capital, below.

Is ECN Capital Corp. Growing?

Over the last three years ECN Capital Corp. has shrunk its earnings per share by an average of 20% per year (measured with a line of best fit). Its revenue is up 29% over last year.

As investors, we are a bit wary of companies that have lower earnings per share, over three years. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. You might want to check this free visual report on analyst forecasts for future earnings.

Has ECN Capital Corp. Been A Good Investment?

ECN Capital Corp. has not done too badly by shareholders, with a total return of 2.1%, over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

We compared total CEO remuneration at ECN Capital Corp. with the amount paid at companies with a similar market capitalization. Our data suggests that it pays above the median CEO pay within that group.

One might like to have seen stronger growth, and the shareholder returns have failed to inspire, over the last three years. Considering this, we wouldn't want to see any big pay rises, although we'd stop short of calling the CEO compensation unfair. Shifting gears from CEO pay for a second, we've picked out 3 warning signs for ECN Capital that investors should be aware of in a dynamic business environment.

Important note: ECN Capital may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:ECN

ECN Capital

ECN Capital Corp. originates, manages, and advises on credit assets on behalf of its partners in North America.

High growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026