Carsten Spohr became the CEO of Deutsche Lufthansa AG (ETR:LHA) in 2014. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Deutsche Lufthansa

How Does Carsten Spohr's Compensation Compare With Similar Sized Companies?

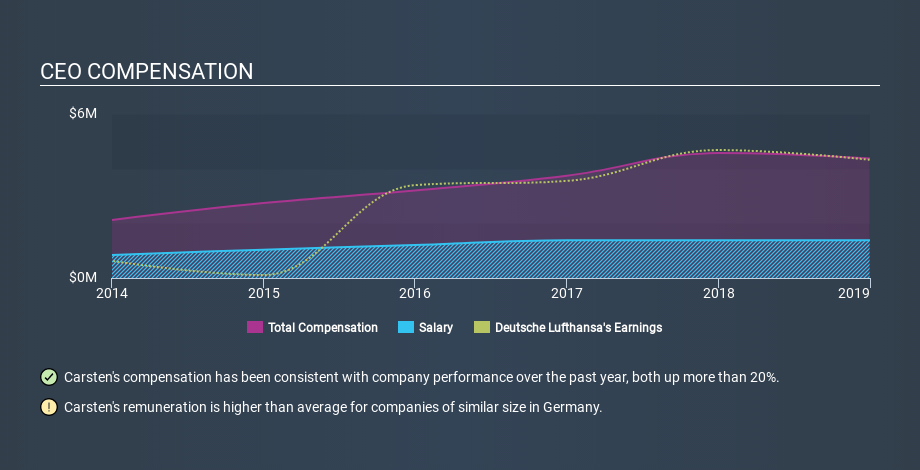

According to our data, Deutsche Lufthansa AG has a market capitalization of €7.2b, and paid its CEO total annual compensation worth €4.4m over the year to December 2018. While we always look at total compensation first, we note that the salary component is less, at €1.4m. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. When we examined a selection of companies with market caps ranging from €3.7b to €11b, we found the median CEO total compensation was €3.1m.

Thus we can conclude that Carsten Spohr receives more in total compensation than the median of a group of companies in the same market, and of similar size to Deutsche Lufthansa AG. However, this doesn't necessarily mean the pay is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance.

The graphic below shows how CEO compensation at Deutsche Lufthansa has changed from year to year.

Is Deutsche Lufthansa AG Growing?

Over the last three years Deutsche Lufthansa AG has shrunk its earnings per share by an average of 3.6% per year (measured with a line of best fit). It achieved revenue growth of 2.6% over the last year.

Sadly for shareholders, earnings per share are actually down, over three years. The fairly low revenue growth fails to impress given that the earnings per share is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. It could be important to check this free visual depiction of what analysts expect for the future.

Has Deutsche Lufthansa AG Been A Good Investment?

Deutsche Lufthansa AG has served shareholders reasonably well, with a total return of 30% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

We examined the amount Deutsche Lufthansa AG pays its CEO, and compared it to the amount paid by similar sized companies. Our data suggests that it pays above the median CEO pay within that group.

We think many shareholders would be underwhelmed with the business growth over the last three years. And shareholder returns are decent but not great. So we doubt many shareholders would consider the CEO pay to be particularly modest! Shareholders may want to check for free if Deutsche Lufthansa insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:LHA

Deutsche Lufthansa

Operates as an aviation company in Germany and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Constellation Software: The Fortress the AI Panic Forgot to Account For

Microsoft: Real‑Terms Economic Value Anchored in Durability, Not Growth Assumptions

First Majestic Silver may see 13.12% profit margin growth in 3 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion