- United States

- /

- Biotech

- /

- NasdaqCM:CRBP

Is Corbus Pharmaceuticals Holdings (NASDAQ:CRBP) In A Good Position To Deliver On Growth Plans?

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Corbus Pharmaceuticals Holdings (NASDAQ:CRBP) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Corbus Pharmaceuticals Holdings

Does Corbus Pharmaceuticals Holdings Have A Long Cash Runway?

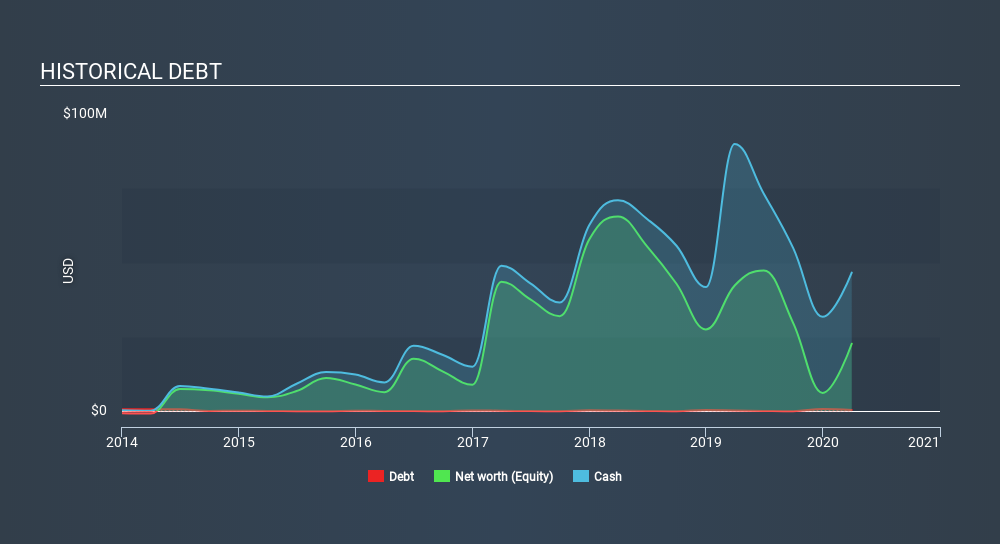

A company's cash runway is calculated by dividing its cash hoard by its cash burn. Corbus Pharmaceuticals Holdings has such a small amount of debt that we'll set it aside, and focus on the US$47m in cash it held at March 2020. In the last year, its cash burn was US$87m. Therefore, from March 2020 it had roughly 6 months of cash runway. Notably, analysts forecast that Corbus Pharmaceuticals Holdings will break even (at a free cash flow level) in about 4 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Corbus Pharmaceuticals Holdings Growing?

It was quite stunning to see that Corbus Pharmaceuticals Holdings increased its cash burn by 348% over the last year. Given that operating revenue was up a stupendous 526% over the last year, there's a good chance the investment will pay off. In light of the data above, we're fairly sanguine about the business growth trajectory. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Corbus Pharmaceuticals Holdings To Raise More Cash For Growth?

Since Corbus Pharmaceuticals Holdings has been boosting its cash burn, the market will likely be considering how it can raise more cash if need be. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of US$486m, Corbus Pharmaceuticals Holdings's US$87m in cash burn equates to about 18% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

How Risky Is Corbus Pharmaceuticals Holdings's Cash Burn Situation?

On this analysis of Corbus Pharmaceuticals Holdings's cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. One real positive is that analysts are forecasting that the company will reach breakeven. Summing up, we think the Corbus Pharmaceuticals Holdings's cash burn is a risk, based on the factors we mentioned in this article. Taking a deeper dive, we've spotted 3 warning signs for Corbus Pharmaceuticals Holdings you should be aware of, and 1 of them is a bit unpleasant.

Of course Corbus Pharmaceuticals Holdings may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqCM:CRBP

Corbus Pharmaceuticals Holdings

A biopharmaceutical company, develops products to defeat serious illness.

Flawless balance sheet moderate.

Market Insights

Community Narratives