Today we'll take a closer look at CI Resources Limited (ASX:CII) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

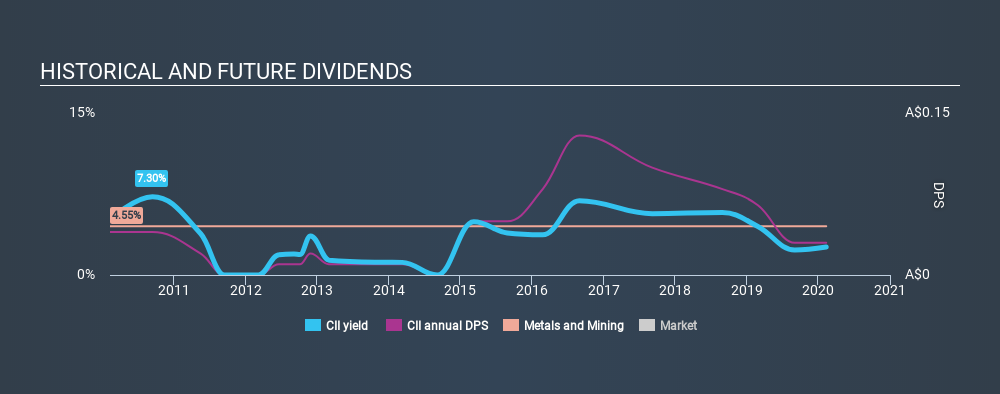

A 2.6% yield is nothing to get excited about, but investors probably think the long payment history suggests CI Resources has some staying power. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. CI Resources paid out 40% of its profit as dividends, over the trailing twelve month period. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. CI Resources paid out 102% of its free cash flow last year, suggesting the dividend is poorly covered by cash flow. While CI Resources's dividends were covered by the company's reported profits, free cash flow is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were CI Resources to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

While the above analysis focuses on dividends relative to a company's earnings, we do note CI Resources's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of CI Resources's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of CI Resources's dividend payments. The dividend has been cut on at least one occasion historically. During the past ten-year period, the first annual payment was AU$0.04 in 2010, compared to AU$0.03 last year. This works out to be a decline of approximately 2.8% per year over that time. CI Resources's dividend hasn't shrunk linearly at 2.8% per annum, but the CAGR is a useful estimate of the historical rate of change.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. CI Resources's EPS have fallen by approximately 13% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, the company has a conservative payout ratio, although we'd note that its cashflow in the past year was substantially lower than its reported profit. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. With this information in mind, we think CI Resources may not be an ideal dividend stock.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in CI Resources stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:PRG

PRL Global

Engages in the mining, processing, and sale of phosphate rock, phosphate dust, and chalk in Africa, Asia, Europe, Australia, North America, and Oceania.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives