- United States

- /

- Pharma

- /

- NYSEAM:CPHI

Is China Pharma Holdings's (NYSEMKT:CPHI) 107% Share Price Increase Well Justified?

The China Pharma Holdings, Inc. (NYSEMKT:CPHI) share price has had a bad week, falling 11%. In contrast, the return over three years has been impressive. Indeed, the share price is up a very strong 107% in that time. So the recent fall in the share price should be viewed in that context. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

See our latest analysis for China Pharma Holdings

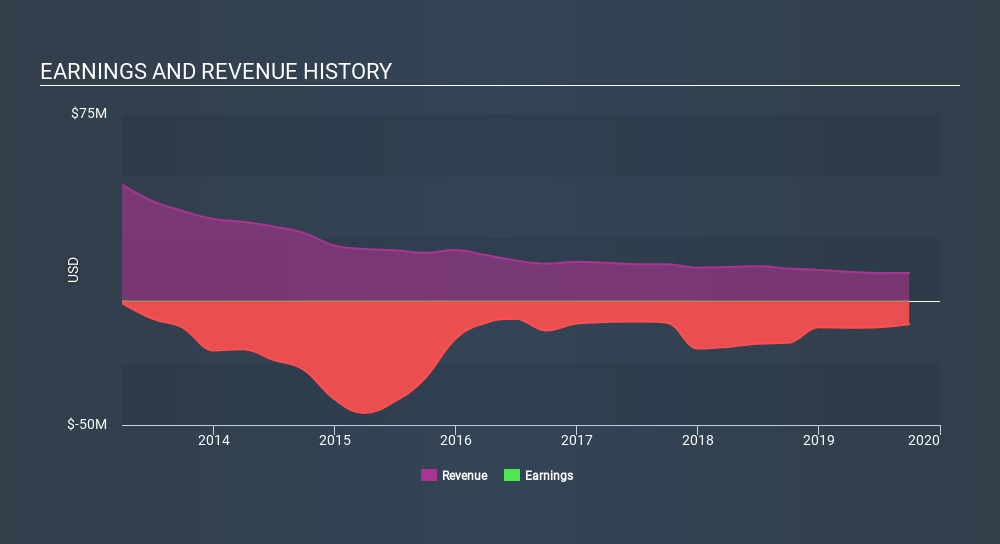

China Pharma Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years China Pharma Holdings saw its revenue shrink by 11% per year. So we wouldn't have expected the share price to gain 27% per year, but it has. It's a good reminder that expectations about the future, not the past history, always impact share prices.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of China Pharma Holdings's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that China Pharma Holdings shareholders have received a total shareholder return of 87% over the last year. That's better than the annualised return of 10% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for China Pharma Holdings you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSEAM:CPHI

China Pharma Holdings

Develops, manufactures, and markets pharmaceutical products for human use in the People’s Republic of China.

Adequate balance sheet slight.

Market Insights

Community Narratives