David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that China Oriental Group Company Limited (HKG:581) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for China Oriental Group

What Is China Oriental Group's Debt?

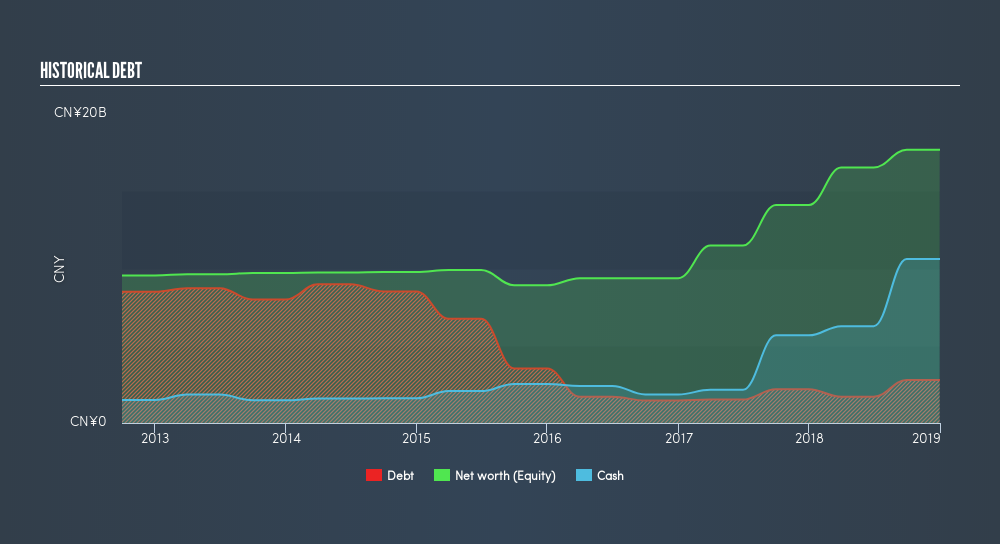

As you can see below, at the end of December 2018, China Oriental Group had CN¥2.79b of debt, up from CN¥2.38b a year ago. Click the image for more detail. However, its balance sheet shows it holds CN¥10.6b in cash, so it actually has CN¥7.82b net cash.

A Look At China Oriental Group's Liabilities

We can see from the most recent balance sheet that China Oriental Group had liabilities of CN¥11.6b falling due within a year, and liabilities of CN¥303.4m due beyond that. Offsetting these obligations, it had cash of CN¥10.6b as well as receivables valued at CN¥2.43b due within 12 months. So it actually has CN¥1.12b more liquid assets than total liabilities.

This short term liquidity is a sign that China Oriental Group could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, China Oriental Group boasts net cash, so it's fair to say it does not have a heavy debt load!

But the other side of the story is that China Oriental Group saw its EBIT decline by 4.3% over the last year. That sort of decline, if sustained, will obviously make debt harder to handle. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if China Oriental Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. China Oriental Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, China Oriental Group recorded free cash flow worth a fulsome 90% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that China Oriental Group has net cash of CN¥7.8b, as well as more liquid assets than liabilities. The cherry on top was that in converted 90% of that EBIT to free cash flow, bringing in CN¥7.8b. So is China Oriental Group's debt a risk? It doesn't seem so to us. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check China Oriental Group's dividend history, without delay!

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:581

China Oriental Group

Manufactures and sells iron and steel products for downstream steel manufacturers in the People’s Republic of China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives