Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Bumitama Agri Ltd. (SGX:P8Z) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Bumitama Agri

What Is Bumitama Agri's Debt?

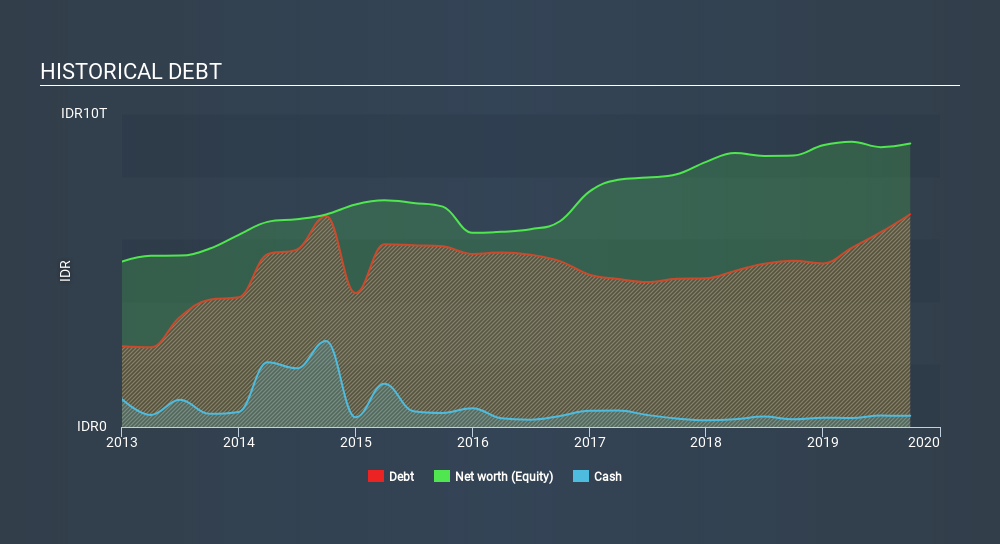

As you can see below, at the end of September 2019, Bumitama Agri had Rp6.80t of debt, up from Rp5.31t a year ago. Click the image for more detail. However, because it has a cash reserve of Rp361.9b, its net debt is less, at about Rp6.44t.

How Strong Is Bumitama Agri's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Bumitama Agri had liabilities of Rp2.02t due within 12 months and liabilities of Rp6.17t due beyond that. On the other hand, it had cash of Rp361.9b and Rp321.5b worth of receivables due within a year. So it has liabilities totalling Rp7.50t more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Bumitama Agri has a market capitalization of Rp13t, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Bumitama Agri has a debt to EBITDA ratio of 4.1, which signals significant debt, but is still pretty reasonable for most types of business. However, its interest coverage of 18.5 is very high, suggesting that the interest expense may well rise in the future, even if there hasn't yet been a major cost attached to that debt. Shareholders should be aware that Bumitama Agri's EBIT was down 52% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Bumitama Agri's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Bumitama Agri recorded free cash flow of 50% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Mulling over Bumitama Agri's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Once we consider all the factors above, together, it seems to us that Bumitama Agri's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Bumitama Agri's dividend history, without delay!

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production and trading of crude palm oil (CPO) and palm kernel (PK) in Indonesia.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives