Is Bonny International Holding (HKG:1906) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Bonny International Holding Limited (HKG:1906) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Bonny International Holding

How Much Debt Does Bonny International Holding Carry?

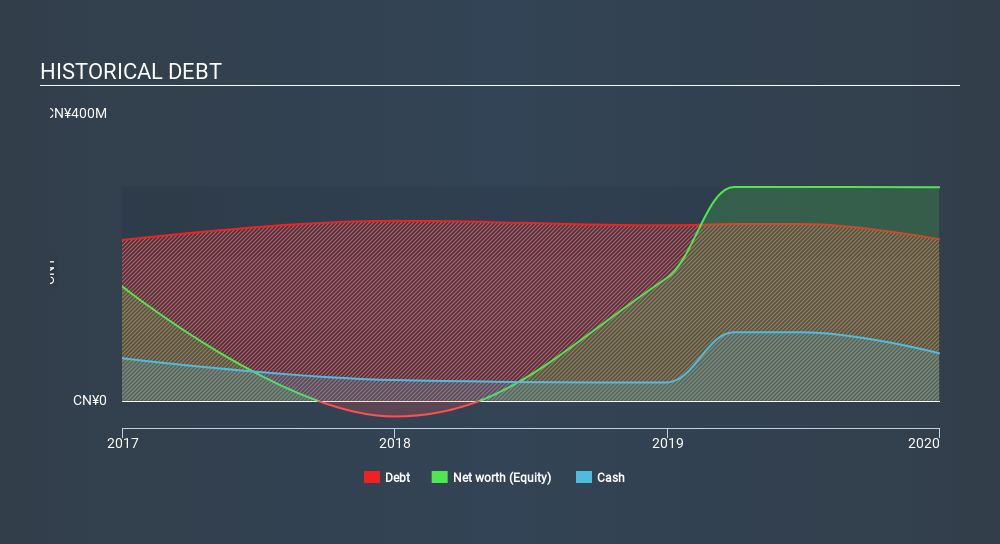

You can click the graphic below for the historical numbers, but it shows that Bonny International Holding had CN¥225.1m of debt in December 2019, down from CN¥244.6m, one year before. However, because it has a cash reserve of CN¥66.1m, its net debt is less, at about CN¥159.0m.

How Strong Is Bonny International Holding's Balance Sheet?

According to the last reported balance sheet, Bonny International Holding had liabilities of CN¥321.0m due within 12 months, and liabilities of CN¥1.39m due beyond 12 months. Offsetting this, it had CN¥66.1m in cash and CN¥89.2m in receivables that were due within 12 months. So its liabilities total CN¥167.1m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Bonny International Holding is worth CN¥591.9m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Bonny International Holding will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Bonny International Holding made a loss at the EBIT level, and saw its revenue drop to CN¥284m, which is a fall of 15%. We would much prefer see growth.

Caveat Emptor

While Bonny International Holding's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost CN¥5.2m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. For example, we would not want to see a repeat of last year's loss of CN¥12m. So we do think this stock is quite risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Bonny International Holding is showing 4 warning signs in our investment analysis , and 2 of those are concerning...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1906

Bonny International Holding

An investment holding company, design, research, develops, produces, and sells intimate wear products.

Slight with imperfect balance sheet.

Market Insights

Community Narratives