- United States

- /

- Trade Distributors

- /

- NasdaqGS:BECN

Is Beacon Roofing Supply (NASDAQ:BECN) A Risky Investment?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Beacon Roofing Supply, Inc. (NASDAQ:BECN) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Beacon Roofing Supply

What Is Beacon Roofing Supply's Debt?

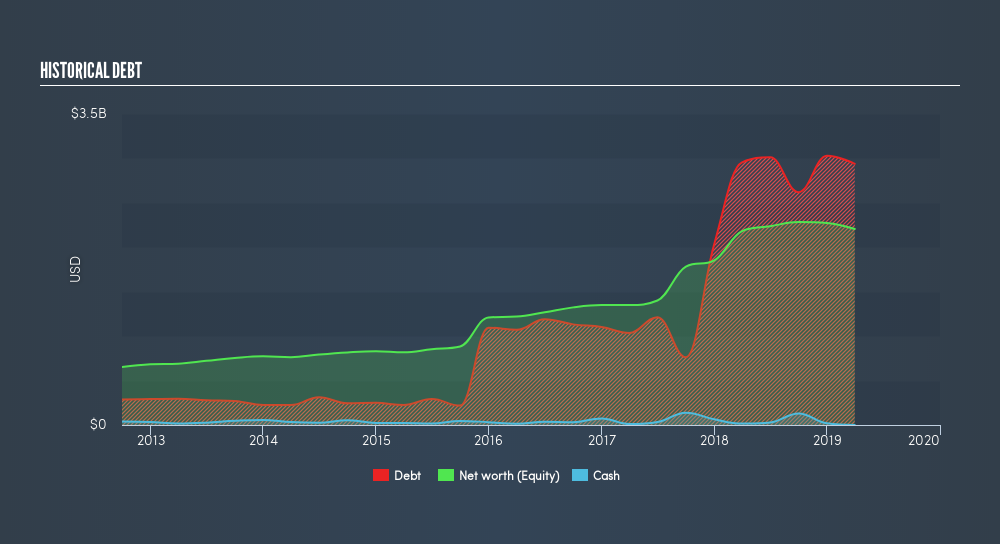

As you can see below, Beacon Roofing Supply had US$2.94b of debt, at March 2019, which is about the same the year before. You can click the chart for greater detail. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Beacon Roofing Supply's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Beacon Roofing Supply had liabilities of US$984.3m due within 12 months and liabilities of US$3.04b due beyond that. Offsetting this, it had US$645.0k in cash and US$869.8m in receivables that were due within 12 months. So its liabilities total US$3.15b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of US$2.50b, we think shareholders really should watch Beacon Roofing Supply's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Since Beacon Roofing Supply does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Beacon Roofing Supply shareholders face the double whammy of a high net debt to EBITDA ratio (5.96), and fairly weak interest coverage, since EBIT is just 1.58 times the interest expense. This means we'd consider it to have a heavy debt load. On a slightly more positive note, Beacon Roofing Supply grew its EBIT at 10% over the last year, further increasing its ability to manage debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Beacon Roofing Supply can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Beacon Roofing Supply produced sturdy free cash flow equating to 76% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

To be frank both Beacon Roofing Supply's interest cover and its track record of managing its debt, based on its EBITDA, make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Once we consider all the factors above, together, it seems to us that Beacon Roofing Supply's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:BECN

Beacon Roofing Supply

Engages in the distribution of residential and non-residential roofing and complementary building products to professional contractors, home builders, building owners, lumberyards, and retailers in the United States and Canada.

Acceptable track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives