Is Banco di Desio e della Brianza S.p.A.'s (BIT:BDB) 4.4% Dividend Worth Your Time?

Could Banco di Desio e della Brianza S.p.A. (BIT:BDB) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

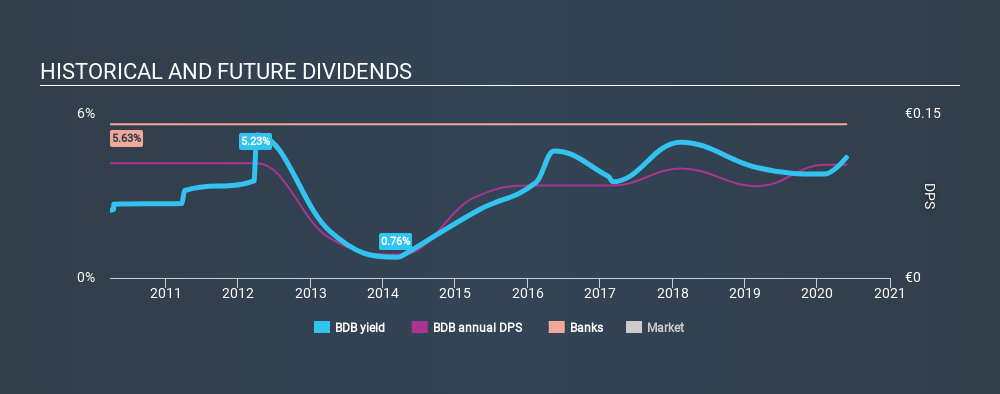

With Banco di Desio e della Brianza yielding 4.4% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. It would not be a surprise to discover that many investors buy it for the dividends. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Banco di Desio e della Brianza paid out 30% of its profit as dividends, over the trailing twelve month period. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. Plus, there is room to increase the payout ratio over time.

Remember, you can always get a snapshot of Banco di Desio e della Brianza's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Banco di Desio e della Brianza's dividend payments. The dividend has been cut on at least one occasion historically. During the past ten-year period, the first annual payment was €0.10 in 2010, compared to €0.10 last year. The dividend has shrunk at a rate of less than 1% a year over this period.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Banco di Desio e della Brianza has grown its earnings per share at 2.1% per annum over the past five years. Banco di Desio e della Brianza is paying out less than half of its earnings, which we like. Earnings per share growth have grown slowly, which is not great, but if the retained earnings can be reinvested effectively, future growth may be stronger.

Conclusion

To summarise, shareholders should always check that Banco di Desio e della Brianza's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're glad to see Banco di Desio e della Brianza has a low payout ratio, as this suggests earnings are being reinvested in the business. Unfortunately, earnings growth has also been mediocre, and the company has cut its dividend at least once in the past. Banco di Desio e della Brianza might not be a bad business, but it doesn't show all of the characteristics we look for in a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 4 warning signs for Banco di Desio e della Brianza that you should be aware of before investing.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About BIT:BDB

Banco di Desio e della Brianza

Provides banking products and services to individuals and enterprises in Italy.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives