Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies. ALK-Abelló A/S (CPH:ALK B) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for ALK-Abelló

How Much Debt Does ALK-Abelló Carry?

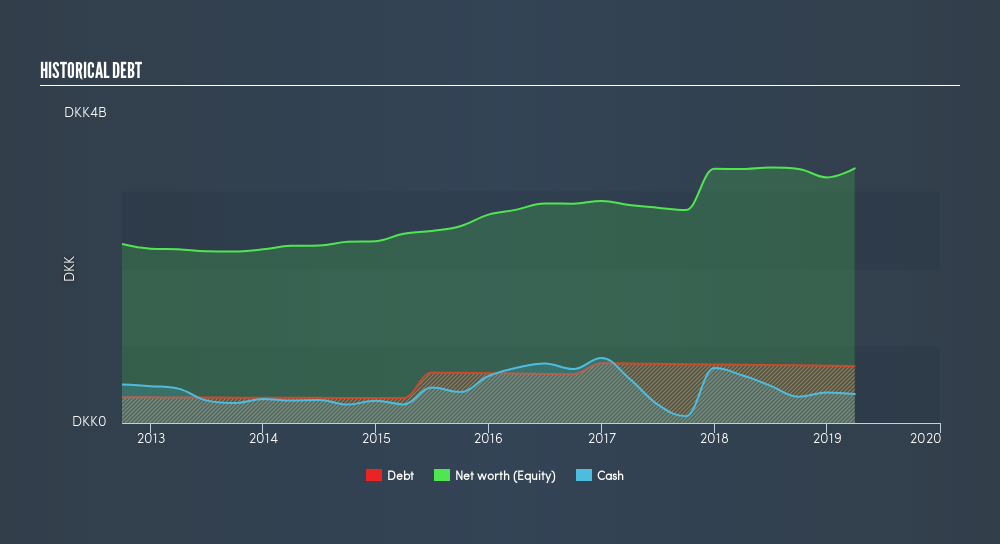

As you can see below, ALK-Abelló had ø736.0m of debt, at March 2019, which is about the same the year before. You can click the chart for greater detail. On the flip side, it has ø375.0m in cash leading to net debt of about ø361.0m.

How Strong Is ALK-Abelló's Balance Sheet?

We can see from the most recent balance sheet that ALK-Abelló had liabilities of ø793.0m falling due within a year, and liabilities of ø1.14b due beyond that. Offsetting these obligations, it had cash of ø375.0m as well as receivables valued at ø649.0m due within 12 months. So it has liabilities totalling ø913.0m more than its cash and near-term receivables, combined.

Since publicly traded ALK-Abelló shares are worth a total of ø17.0b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Because it carries more debt than cash, we think it's worth watching ALK-Abelló's balance sheet over time. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if ALK-Abelló can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year ALK-Abelló managed to grow its revenue by 5.5%, to ø3.0b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, ALK-Abelló had negative earnings before interest and tax (EBIT), over the last year. To be specific the EBIT loss came in at ø37m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through ø205m of cash over the last year. So to be blunt we think it is risky. For riskier companies like ALK-Abelló I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About CPSE:ALK B

ALK-Abelló

Operates as an allergy solutions company in Europe, North America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives