Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll take a closer look at AEW UK Long Lease REIT plc (LON:AEWL) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

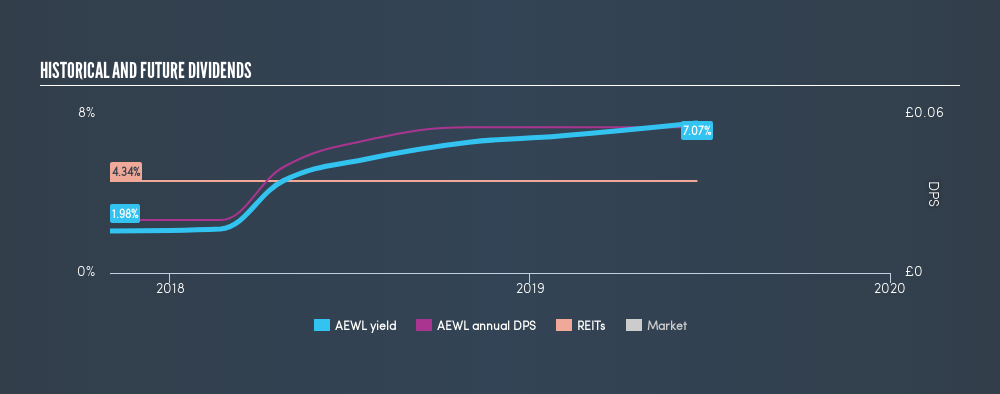

In this case, AEW UK Long Lease REIT pays a decent-sized 7.1% dividend yield, and has been distributing cash to shareholders for the past two years. A high yield probably looks enticing, but investors are likely wondering about the short payment history. The company also bought back stock during the year, equivalent to approximately 18% of the company's market capitalisation at the time. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, AEW UK Long Lease REIT paid out 86% of its profit as dividends. Paying out a majority of its earnings limits the amount that can be reinvested in the business. This may indicate a commitment to paying a dividend, or a dearth of investment opportunities.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. The company paid out 86% of its free cash flow as dividends last year, which is adequate, but reduces the wriggle room in the event of a downturn. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Remember, you can always get a snapshot of AEW UK Long Lease REIT's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. During the past two-year period, the first annual payment was UK£0.02 in 2017, compared to UK£0.055 last year. Dividends per share have grown at approximately 66% per year over this time.

We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. AEW UK Long Lease REIT earnings have been growing very quickly recently, but given that it is paying out more than half of its earnings, we wonder if it will have enough capital to fund further growth in the future.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. AEW UK Long Lease REIT's is paying out more than half its income as dividends, but at least the dividend is covered by both reported earnings and cashflow. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. Ultimately, AEW UK Long Lease REIT comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Now, if you want to look closer, it would be worth checking out our free research on AEW UK Long Lease REIT management tenure, salary, and performance.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:AIRE

Alternative Income REIT

Alternative Income REIT PLC aims to generate a secure and predictable income return, sustainable in real terms, whilst at least maintaining capital values, in real terms, through investment in a diversified portfolio of UK properties, predominantly within the alternative and specialist sectors.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives