- United States

- /

- Specialized REITs

- /

- NYSE:IRM

Iron Mountain (NYSE:IRM) Pursues Expanded Government Digitalization Opportunity with New Treasury RFQ

Reviewed by Simply Wall St

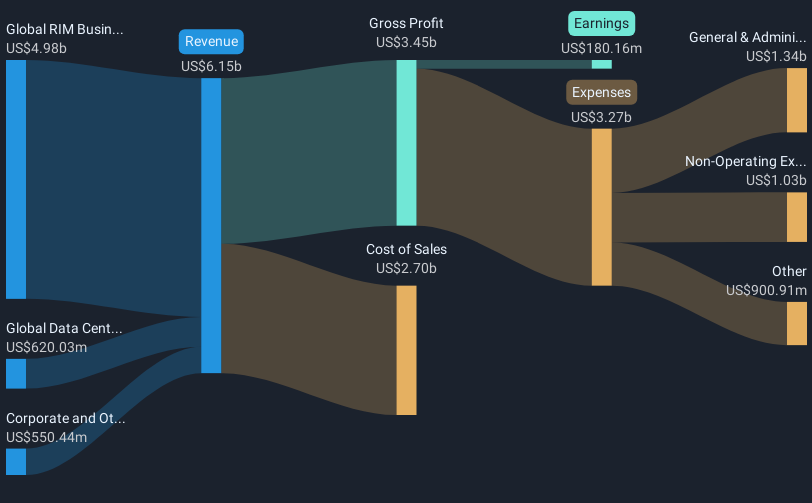

Iron Mountain (NYSE:IRM) has been actively pursuing digitization projects, positioning itself favorably for a new Government contract, which aligns with its recent efforts to expand its digital transformation services. Over the last quarter, Iron Mountain's stock price rose by 16%, a noteworthy movement that surpasses the broader market's 9% annual growth. This increase in share price may have been supported by the company's optimistic earnings guidance and strategic steps towards acquisition in the ALM sector. These factors contributed stability and potential growth opportunities, thus creating an overall positive sentiment around Iron Mountain's market performance.

Iron Mountain's strategic focus on digital transformation and significant initiatives like pursuing digitization projects and securing a government contract are pivotal. These efforts align well with the company's growth strategy, notably its Matterhorn strategy, driving integrated solutions across various business units. This initiative could positively impact future revenue streams and profit margins by boosting cross-selling opportunities and enhancing customer engagement.

Over the last five years, Iron Mountain's total shareholder return, which includes both share price appreciation and dividends, was a very large 417.77%. This reflects strong long-term performance, depicting a compelling growth narrative compared to its more recent 1-year performance, which surpasses the US Specialized REITs industry growth of 7.3% and the broader market's return of 9.8% over the same period.

The company's shares trade at a discount of approximately 12.3% to the consensus price target of US$115.30, suggesting potential upside based on current valuations and expected growth. The recent digitization efforts and new contracts are anticipated to influence forecasts positively, with analysts expecting revenue and earnings to grow significantly over the medium term. However, the consensus assumes a higher PE ratio in the future, at 61.1x, to meet the US$115 target, compared to the current ratio of 234.3x, highlighting potential moderation in valuation metrics in the years ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IRM

Iron Mountain

Iron Mountain Incorporated (NYSE: IRM) is trusted by more than 240,000 customers in 61 countries, including approximately 95% of the Fortune 1000, to help unlock value and intelligence from their assets through services that transcend the physical and digital worlds.

Medium-low and undervalued.

Similar Companies

Market Insights

Community Narratives