- Brazil

- /

- Auto Components

- /

- BOVESPA:MYPK3

Iochpe-Maxion S.A. (BVMF:MYPK3) Analysts Just Trimmed Their Revenue Forecasts By 16%

The analysts covering Iochpe-Maxion S.A. (BVMF:MYPK3) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

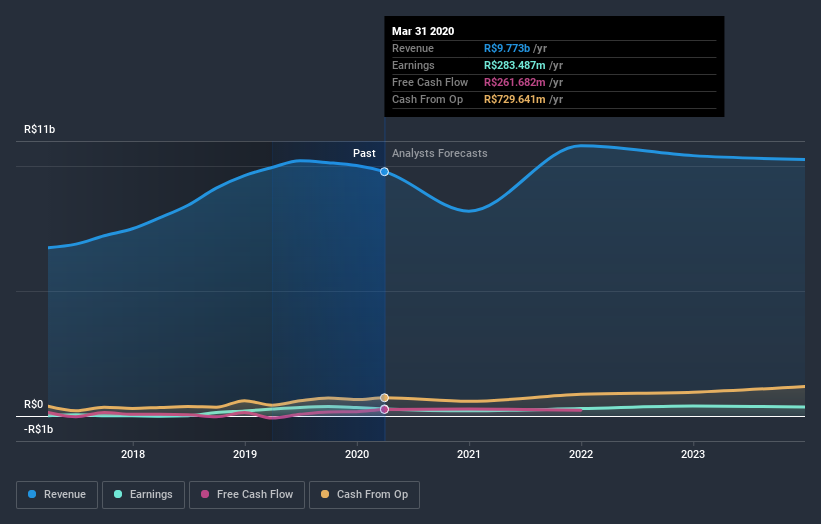

Following the latest downgrade, the eight analysts covering Iochpe-Maxion provided consensus estimates of R$8.2b revenue in 2020, which would reflect a not inconsiderable 16% decline on its sales over the past 12 months. Before the latest update, the analysts were foreseeing R$9.8b of revenue in 2020. It looks like forecasts have become a fair bit less optimistic on Iochpe-Maxion, given the substantial drop in revenue estimates.

See our latest analysis for Iochpe-Maxion

There was no particular change to the consensus price target of R$22.69, with Iochpe-Maxion's latest outlook seemingly not enough to result in a change of valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Iochpe-Maxion, with the most bullish analyst valuing it at R$32.00 and the most bearish at R$13.00 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast revenue decline of 16%, a significant reduction from annual growth of 11% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 7.5% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Iochpe-Maxion is expected to lag the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Iochpe-Maxion this year. They also expect company revenue to perform worse than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Iochpe-Maxion going forwards.

Of course, there's always more to the story. At least one of Iochpe-Maxion's eight analysts has provided estimates out to 2023, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you decide to trade Iochpe-Maxion, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:MYPK3

Iochpe-Maxion

Produces and sells automotive wheels and structural components for commercial and light vehicles in North America, South America, Europe, Asia, and internationally.

Undervalued with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion