Investors Who Bought VR Education Holdings (ISE:6VR) Shares A Year Ago Are Now Down 60%

Taking the occasional loss comes part and parcel with investing on the stock market. And unfortunately for VR Education Holdings Plc (ISE:6VR) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 60%. VR Education Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. It's up 4.9% in the last seven days.

See our latest analysis for VR Education Holdings

VR Education Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

VR Education Holdings grew its revenue by 32% over the last year. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 60% in that time. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

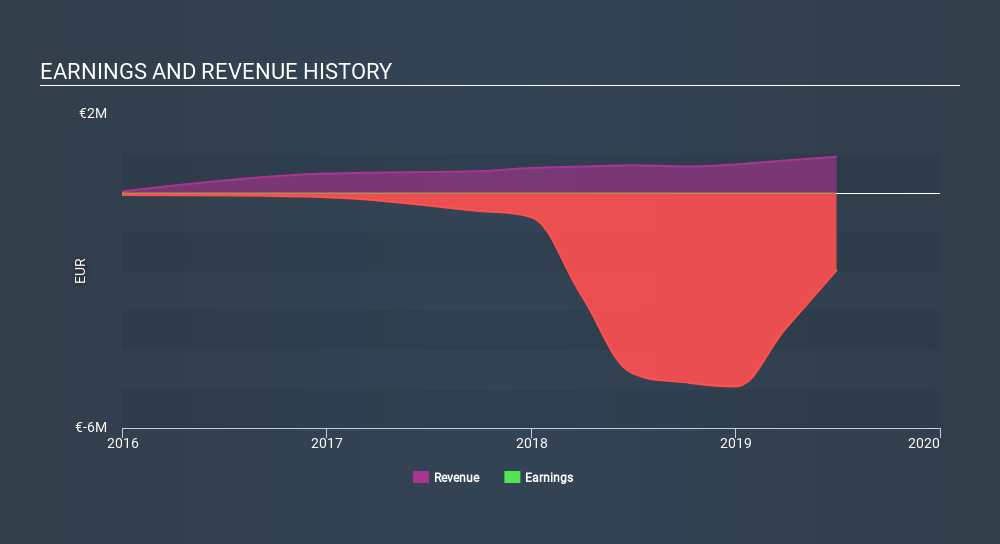

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on VR Education Holdings

A Different Perspective

VR Education Holdings shareholders are down 60% for the year, even worse than the market loss of 14%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 40% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 7 warning signs for VR Education Holdings (of which 2 shouldn't be ignored!) you should know about.

We will like VR Education Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ISE:EXR

ENGAGE XR Holdings

Operates as a virtual reality software company in education and corporate training sector worldwide.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives