- United States

- /

- Food

- /

- NasdaqCM:SANW

Investors Who Bought S&W Seed (NASDAQ:SANW) Shares Three Years Ago Are Now Down 55%

Investing in stocks inevitably means buying into some companies that perform poorly. Long term S&W Seed Company (NASDAQ:SANW) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 55% share price collapse, in that time.

View our latest analysis for S&W Seed

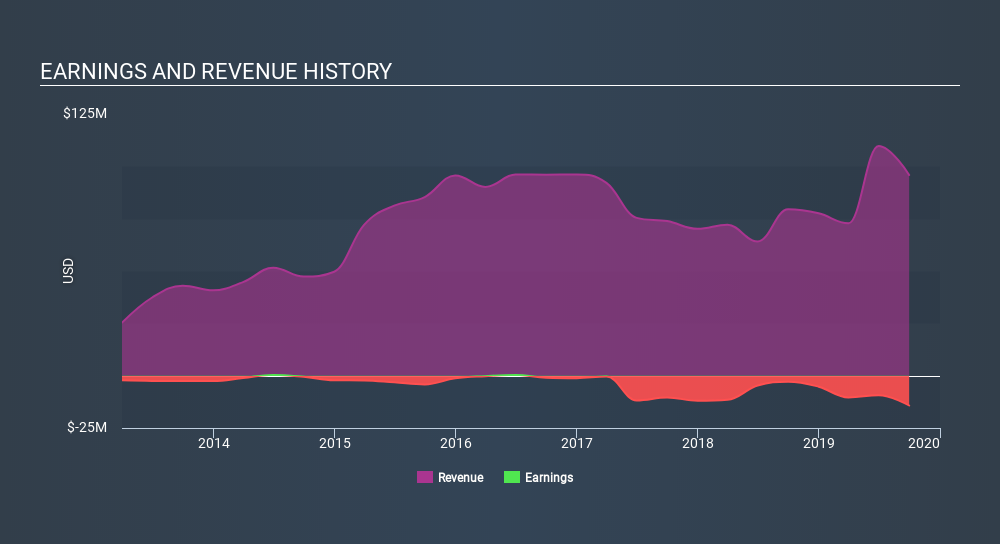

Given that S&W Seed didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, S&W Seed saw its revenue grow by 0.04% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 23% during the period. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

S&W Seed shareholders are up 15% for the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 14% per year, over five years. It could well be that the business is stabilizing. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:SANW

S&W Seed

An agricultural company, engages in breeding, growing, processing, and sale of alfalfa and sorghum seeds in North and South America, Australia, and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives