- United Kingdom

- /

- Capital Markets

- /

- LSE:SNN

Investors Who Bought Sanne Group (LON:SNN) Shares Three Years Ago Are Now Up 94%

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, the Sanne Group plc (LON:SNN) share price is up 94% in the last three years, clearly besting than the market return of around 11% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 5.5%, including dividends.

Check out our latest analysis for Sanne Group

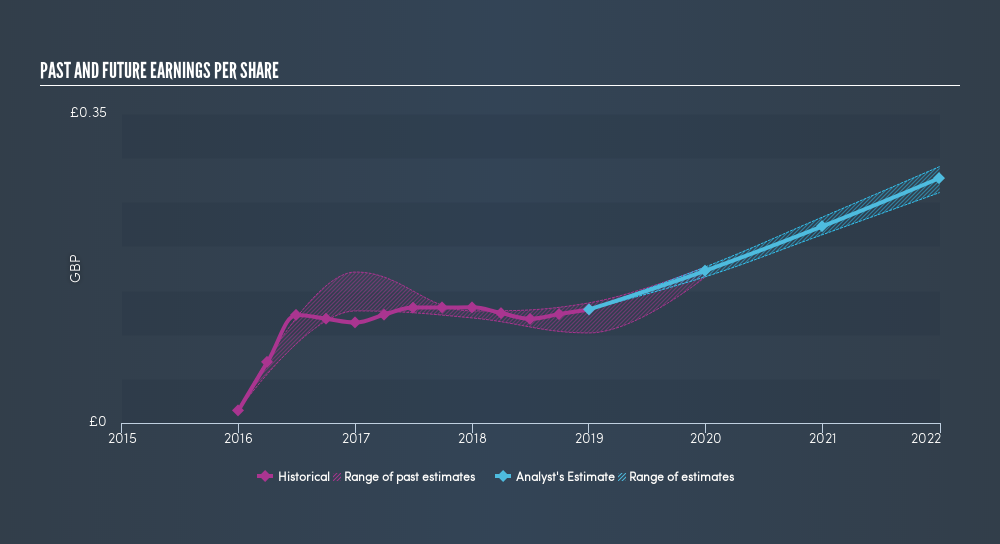

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Sanne Group was able to grow its EPS at 108% per year over three years, sending the share price higher. The average annual share price increase of 25% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock. Of course, with a P/E ratio of 56.90, the market remains optimistic.

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Sanne Group's TSR for the last 3 years was 105%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Pleasingly, Sanne Group's total shareholder return last year was 5.5%. And yes, that does include the dividend. That falls short of the 27% it has made, for shareholders, each year, over three years. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Sanne Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:SNN

Sanne Group

Sanne Group plc provides corporate, fund and private client administration, reporting, and fiduciary services in Europe, the Middle East, Africa, the Channel Islands, North America, the Asia-Pacific, and Mauritius.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives