Investors Who Bought QPR Software Oyj (HEL:QPR1V) Shares Five Years Ago Are Now Up 128%

When you buy a stock there is always a possibility that it could drop 100%. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of QPR Software Oyj (HEL:QPR1V) stock is up an impressive 128% over the last five years. On top of that, the share price is up 13% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 7.1% in 90 days).

View our latest analysis for QPR Software Oyj

While QPR Software Oyj made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years QPR Software Oyj saw its revenue grow at 0.6% per year. Put simply, that growth rate fails to impress. In comparison, the share price rise of 18% per year over the last half a decade is pretty impressive. While we wouldn't be overly concerned, it might be worth checking whether you think the fundamental business gains really justify the share price action. It may be that the market is pretty optimistic about QPR Software Oyj.

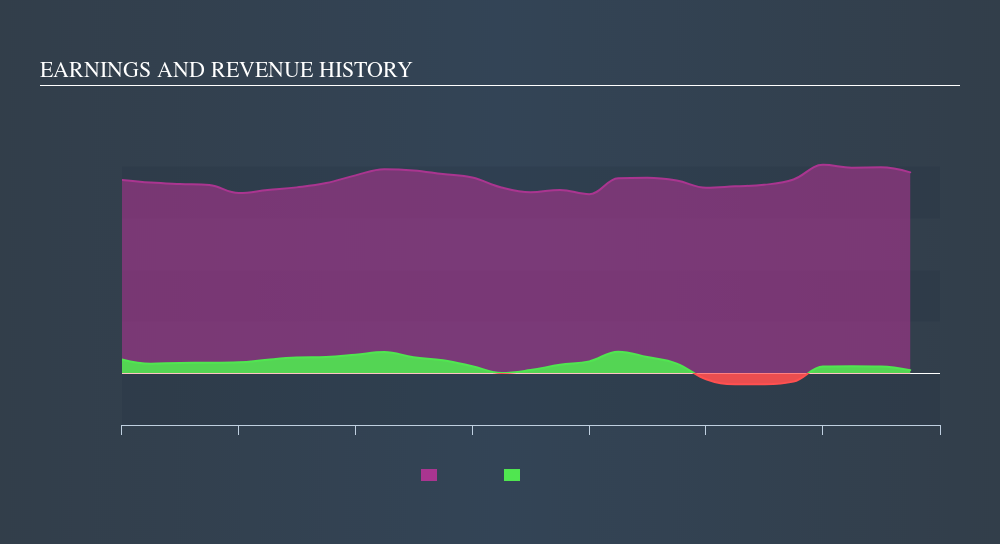

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between QPR Software Oyj's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for QPR Software Oyj shareholders, and that cash payout contributed to why its TSR of 149%, over the last 5 years, is better than the share price return.

A Different Perspective

We're pleased to report that QPR Software Oyj shareholders have received a total shareholder return of 36% over one year. That gain is better than the annual TSR over five years, which is 20%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: QPR Software Oyj may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About HLSE:QPR1V

QPR Software Oyj

Provides services and software tools for developing business processes and enterprise architecture in Finland, rest of Europe, Russia, Turkey, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives