- Australia

- /

- Consumer Services

- /

- ASX:MFD

Investors Who Bought Mayfield Childcare (ASX:MFD) Shares Three Years Ago Are Now Down 17%

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Mayfield Childcare Limited (ASX:MFD) shareholders have had that experience, with the share price dropping 17% in three years, versus a market return of about 24%.

See our latest analysis for Mayfield Childcare

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Mayfield Childcare moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. It's good to see that Mayfield Childcare has increased its revenue over the last three years. But it's not clear to us why the share price is down. It might be worth diving deeper into the fundamentals, lest an opportunity goes begging.

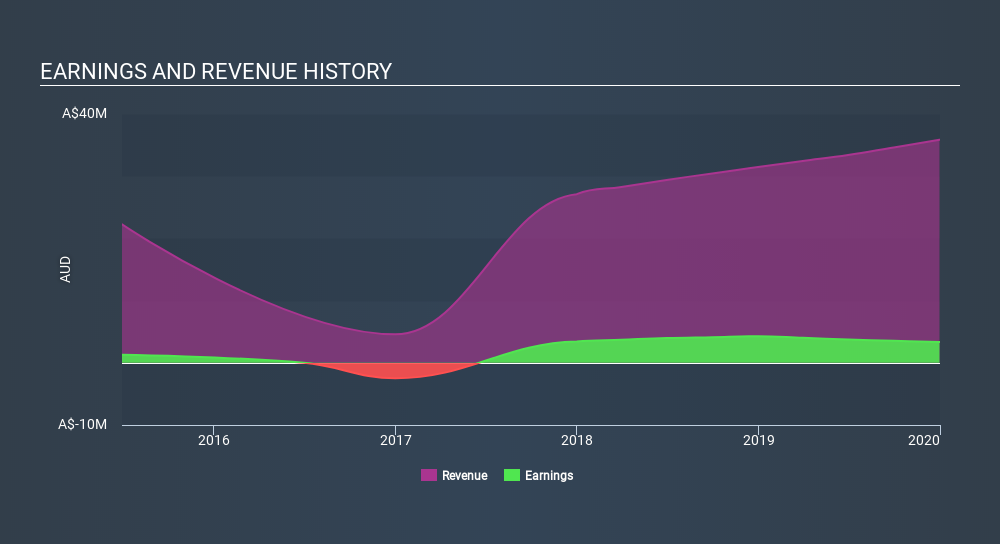

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Mayfield Childcare's TSR for the last 3 years was 4.5%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Mayfield Childcare shareholders have gained 8.0% (in total) over the last year. That's including the dividend. That gain actually surpasses the 1.5% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Mayfield Childcare on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Mayfield Childcare has 5 warning signs we think you should be aware of.

We will like Mayfield Childcare better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:MFD

Mayfield Childcare

Owns and operates long day care centers in Victoria, Queensland, and South Australia.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives