Investors Who Bought 1933 Industries (CNSX:TGIF) Shares Three Years Ago Are Now Up 267%

The last three months have been tough on 1933 Industries Inc. (CNSX:TGIF) shareholders, who have seen the share price decline a rather worrying 39%. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. In fact, the share price is up a full 267% compared to three years ago. To some, the recent share price pullback wouldn't be surprising after such a good run. The thing to consider is whether the underlying business is doing well enough to support the current price.

View our latest analysis for 1933 Industries

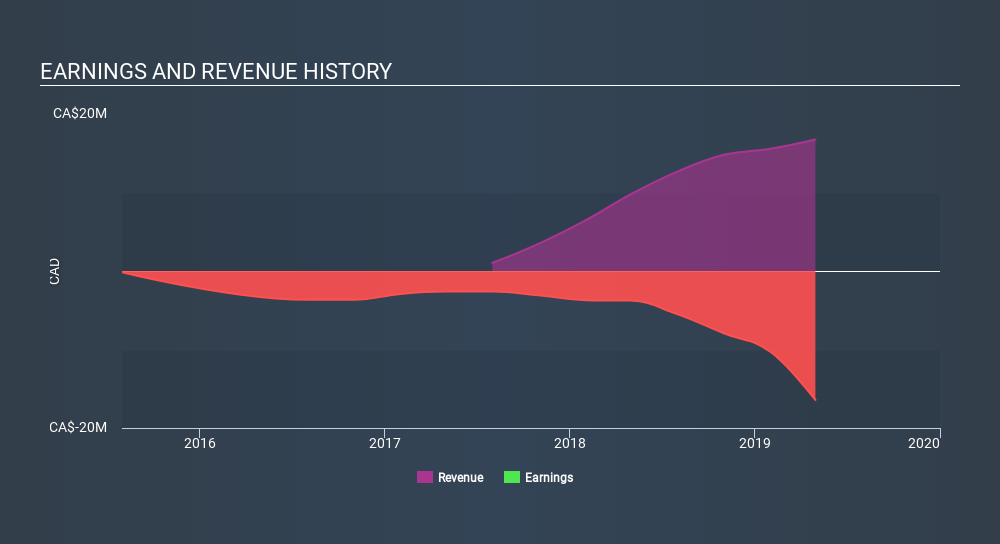

1933 Industries isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

You can see below how revenue has changed over time.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling 1933 Industries stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Over the last year, 1933 Industries shareholders took a loss of 49%. In contrast the market gained about 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 54% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. If you would like to research 1933 Industries in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CNSX:TGIF

1933 Industries

Engages in the cultivation, extraction, and production of cannabis products in the United States.

Good value low.

Similar Companies

Market Insights

Community Narratives