- United States

- /

- Packaging

- /

- NasdaqGS:TRS

Introducing TriMas (NASDAQ:TRS), A Stock That Climbed 34% In The Last Three Years

Investors can buy low cost index fund if they want to receive the average market return. But across the board there are plenty of stocks that underperform the market. Unfortunately for shareholders, while the TriMas Corporation (NASDAQ:TRS) share price is up 34% in the last three years, that falls short of the market return. Unfortunately, the share price has fallen 1.7% over twelve months.

See our latest analysis for TriMas

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

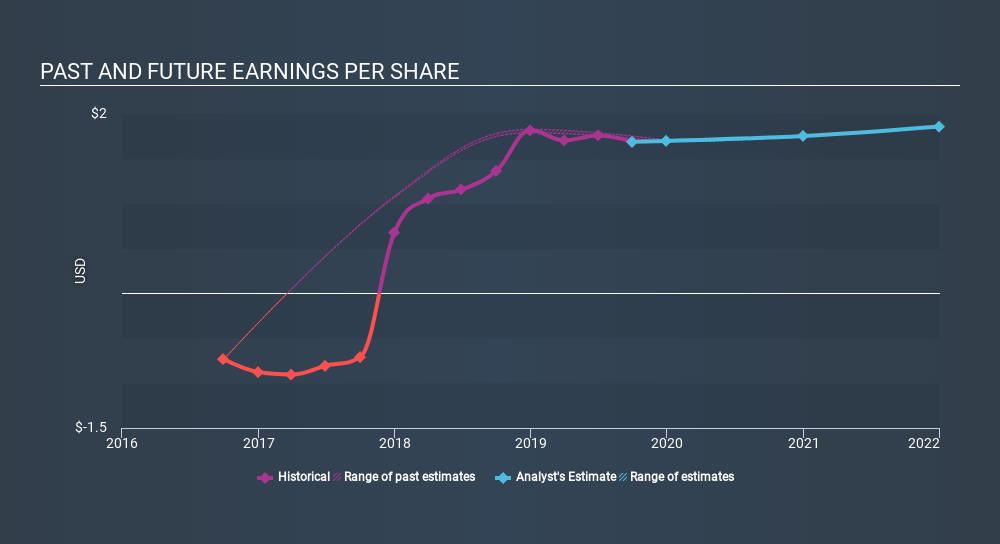

TriMas became profitable within the last three years. That would generally be considered a positive, so we'd expect the share price to be up.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how TriMas has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at TriMas's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered TriMas's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that TriMas's TSR, at 34% is higher than its share price return of 34%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

TriMas shareholders are down 1.7% for the year, but the market itself is up 23%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 4.4% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with TriMas .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:TRS

TriMas

Engages in the design, development, manufacture, and sale of products for consumer products, aerospace, and industrial markets worldwide.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives