It's not a secret that every investor will make bad investments, from time to time. But it should be a priority to avoid stomach churning catastrophes, wherever possible. It must have been painful to be a STS Group AG (ETR:SF3) shareholder over the last year, since the stock price plummeted 76% in that time. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. We wouldn't rush to judgement on STS Group because we don't have a long term history to look at. Furthermore, it's down 32% in about a quarter. That's not much fun for holders.

See our latest analysis for STS Group

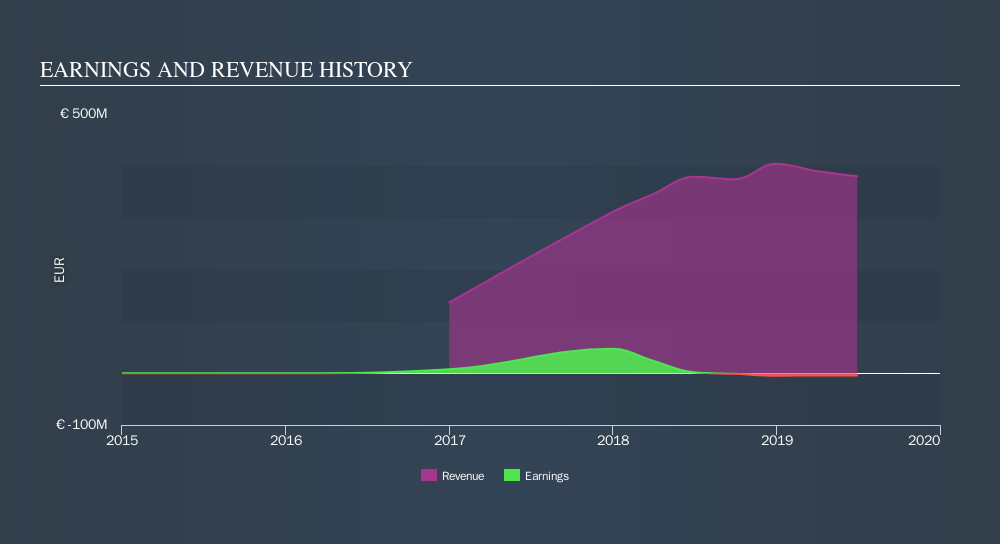

Given that STS Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

STS Group grew its revenue by 0.2% over the last year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the 76% share price implosion is unexpected.. Clearly the market was expecting better, and this may blow out projections of profitability. But if it will make money, albeit later than previously believed, this could be an opportunity.

The company's revenue and earnings (over time) are depicted in the image below.

Take a more thorough look at STS Group's financial health with this free report on its balance sheet.

A Different Perspective

We doubt STS Group shareholders are happy with the loss of 76% over twelve months. That falls short of the market, which lost 1.5%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 32%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About XTRA:SF3

STS Group

Supplies components and systems for the commercial vehicle and automotive industry in Germany, France, Mexico, the United States, and China.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives