- United States

- /

- Biotech

- /

- NasdaqGS:RGNX

Introducing REGENXBIO (NASDAQ:RGNX), The Stock That Zoomed 203% In The Last Three Years

REGENXBIO Inc. (NASDAQ:RGNX) shareholders have seen the share price descend 22% over the month. But in three years the returns have been great. In three years the stock price has launched 203% higher: a great result. So the recent fall in the share price should be viewed in that context. If the business can perform well for years to come, then the recent drop could be an opportunity.

See our latest analysis for REGENXBIO

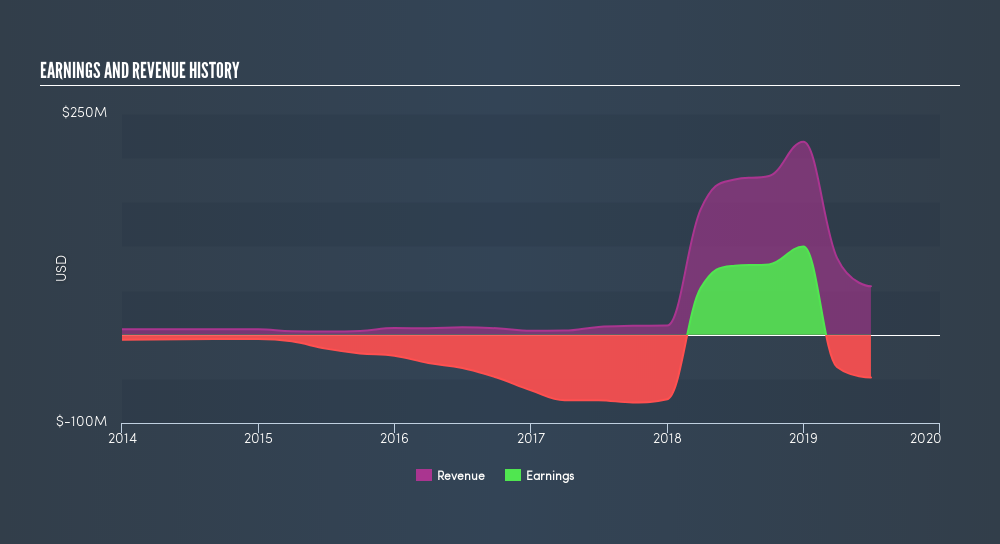

Because REGENXBIO is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years REGENXBIO saw its revenue grow at 79% per year. That's well above most pre-profit companies. Meanwhile, the share price performance has been pretty solid at 45% compound over three years. But it does seem like the market is paying attention to strong revenue growth. Nonetheless, we'd say REGENXBIO is still worth investigating - successful businesses can often keep growing for long periods.

This free interactive report on REGENXBIO's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

REGENXBIO shareholders are down 44% for the year, but the broader market is up 1.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 45% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:RGNX

REGENXBIO

A clinical-stage biotechnology company, provides gene therapies that deliver functional genes to cells with genetic defects in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives