- India

- /

- Renewable Energy

- /

- NSEI:RTNPOWER

Introducing RattanIndia Power (NSE:RTNPOWER), The Stock That Tanked 76%

RattanIndia Power Limited (NSE:RTNPOWER) shareholders will doubtless be very grateful to see the share price up 57% in the last month. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Five years have seen the share price descend precipitously, down a full 76%. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead.

Check out our latest analysis for RattanIndia Power

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, RattanIndia Power moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 11% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

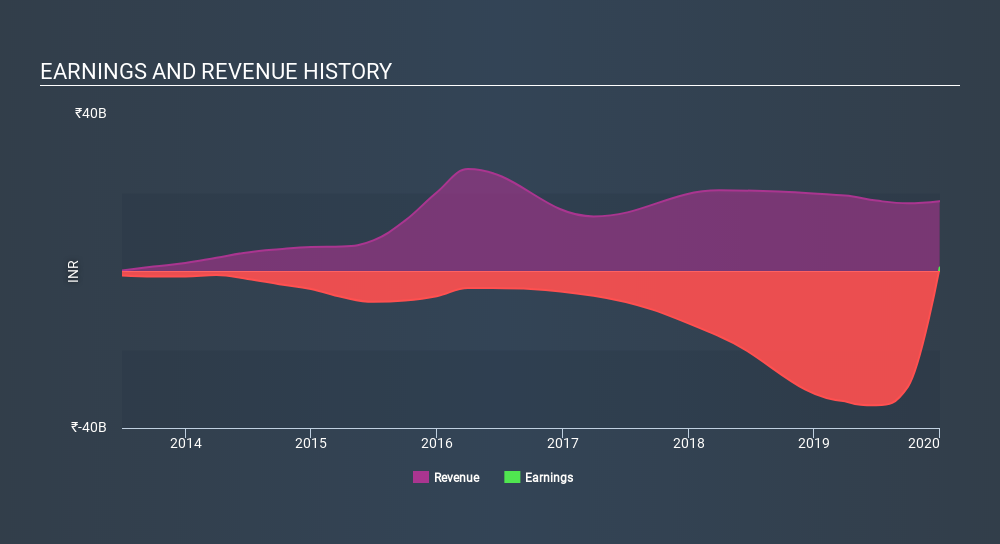

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on RattanIndia Power's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that RattanIndia Power shareholders have received a total shareholder return of 5.9% over one year. That certainly beats the loss of about 25% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand RattanIndia Power better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for RattanIndia Power you should be aware of, and 2 of them shouldn't be ignored.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:RTNPOWER

RattanIndia Power

Together with its subsidiary, Poena Power Development Limited, engages in power generation, distribution, trading and transmission, and other ancillary and incidental activities in India.

Questionable track record with imperfect balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)