- Australia

- /

- Metals and Mining

- /

- ASX:OKU

Introducing Oklo Resources (ASX:OKU), The Stock That Zoomed 217% In The Last Five Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While Oklo Resources Limited (ASX:OKU) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 17% in the last quarter. But that doesn't change the fact that the returns over the last five years have been very strong. Indeed, the share price is up an impressive 217% in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for Oklo Resources

With zero revenue generated over twelve months, we don't think that Oklo Resources has proved its business plan yet. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that Oklo Resources finds some valuable resources, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Of course, if you time it right, high risk investments like this can really pay off, as Oklo Resources investors might know.

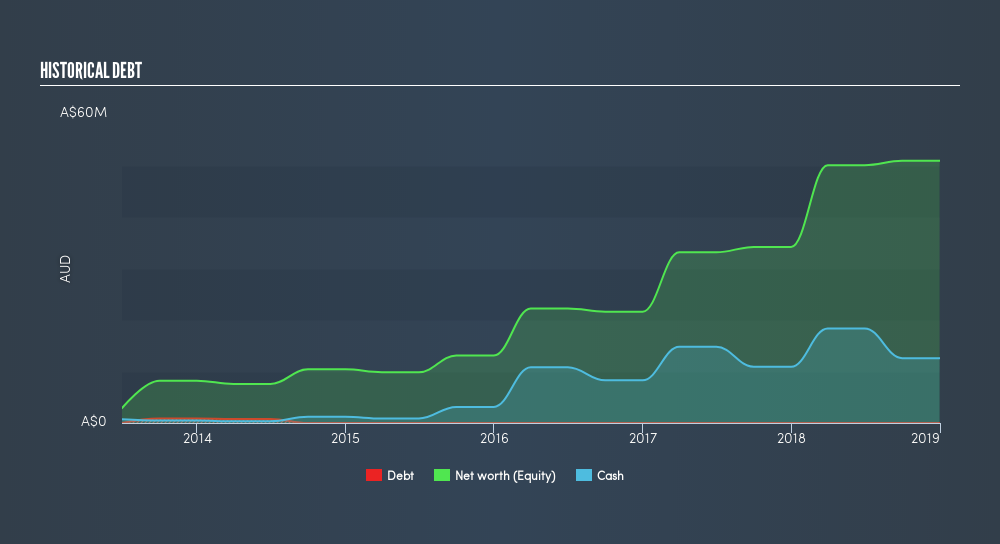

When it reported in December 2018 Oklo Resources had minimal net cash consider its expenditure: just AU$11m to be specific. So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. It's a testament to the popularity of the business plan that the share price gained 26% per year, over 5 years, despite the weak balance sheet. You can click on the image below to see (in greater detail) how Oklo Resources's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. One thing you can do is check if company insiders are buying shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

A Different Perspective

While the broader market gained around 9.8% in the last year, Oklo Resources shareholders lost 48%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 26%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:OKU

Oklo Resources

Oklo Resources Limited engages in the acquisition, exploration, and development of mineral properties in the Republic of Mali.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives