Introducing Intense Technologies (NSE:INTENTECH), The Stock That Dropped 35% In The Last Year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Intense Technologies Limited (NSE:INTENTECH) shareholders over the last year, as the share price declined 35%. That falls noticeably short of the market return of around 8.4%. Intense Technologies hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days.

View our latest analysis for Intense Technologies

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Intense Technologies share price fell, it actually saw its earnings per share (EPS) improve by 132%. It's quite possible that growth expectations may have been unreasonable in the past.

It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

Given the yield is quite low, at 0.8%, we doubt the dividend can shed much light on the share price. Intense Technologies managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

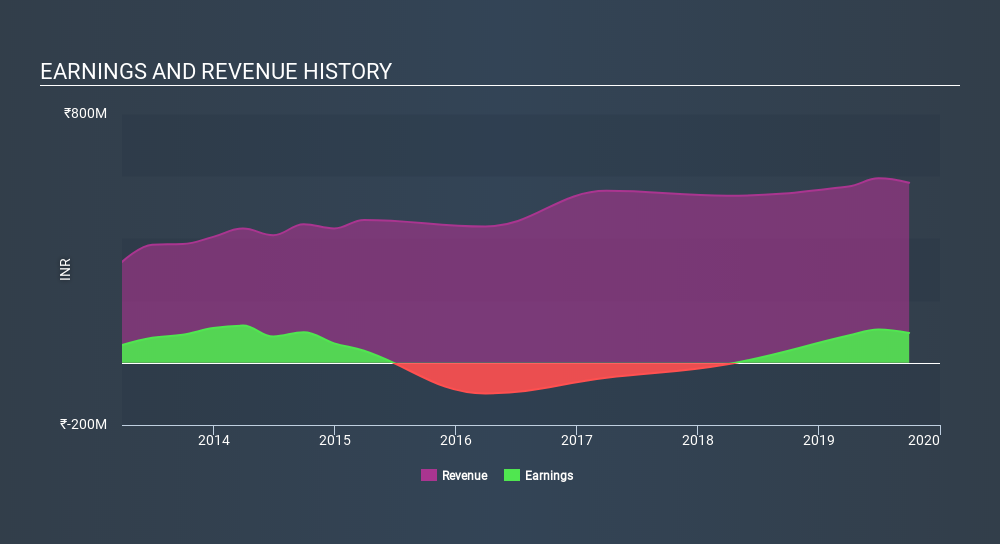

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While Intense Technologies shareholders are down 35% for the year (even including dividends) , the market itself is up 8.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 18% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Be aware that Intense Technologies is showing 4 warning signs in our investment analysis , and 2 of those are potentially serious...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:INTENTECH

Intense Technologies

Provides enterprise platform and IP-enabled service organization services in India.

Flawless balance sheet slight.

Market Insights

Community Narratives