- France

- /

- Commercial Services

- /

- ENXTPA:ELIS

Introducing Elis (EPA:ELIS), The Stock That Dropped 17% In The Last Year

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Elis SA (EPA:ELIS) share price is down 17% in the last year. That's well bellow the market return of 8.8%. On the bright side, the stock is actually up 5.6% in the last three years. It's up 2.2% in the last seven days.

Check out our latest analysis for Elis

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Elis share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

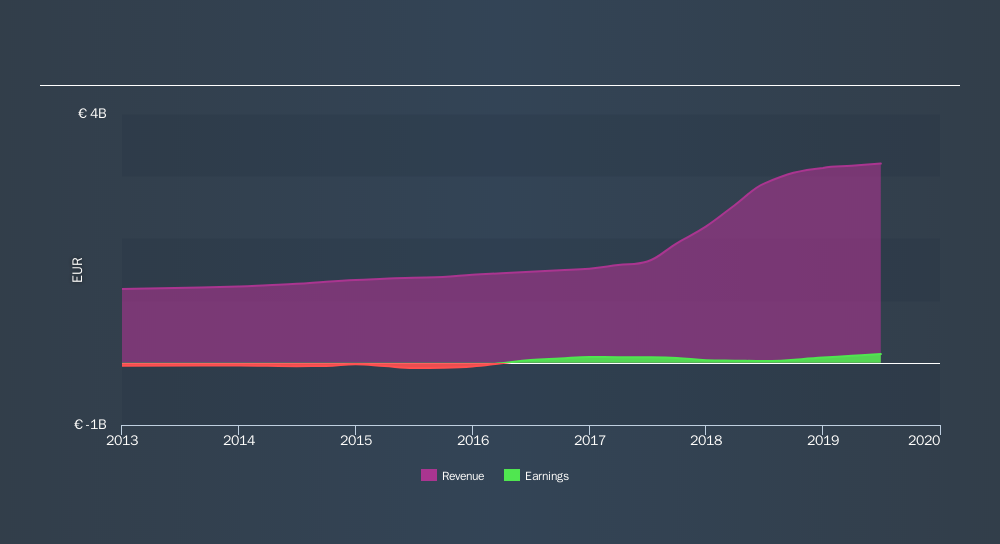

Elis's revenue is actually up 11% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

Elis is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Elis stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Elis, it has a TSR of -15% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Elis shareholders are down 15% for the year (even including dividends), but the broader market is up 8.8%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Fortunately the longer term story is brighter, with total returns averaging about 5.8% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Before deciding if you like the current share price, check how Elis scores on these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:ELIS

Elis

Engages in the provision of flat linen, workwear, and hygiene and well-being solutions in France, Central Europe, Scandinavia, Eastern Europe, the United Kingdom, Ireland, Latin America, Southern Europe, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives