- Italy

- /

- Consumer Services

- /

- BIT:ABTG

Introducing Alfio Bardolla Training Group (BIT:ABTG), The Stock That Dropped 50% In The Last Year

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Alfio Bardolla Training Group S.p.A. (BIT:ABTG) share price slid 50% over twelve months. That's well bellow the market return of 2.3%. We wouldn't rush to judgement on Alfio Bardolla Training Group because we don't have a long term history to look at. Furthermore, it's down 12% in about a quarter. That's not much fun for holders.

Check out our latest analysis for Alfio Bardolla Training Group

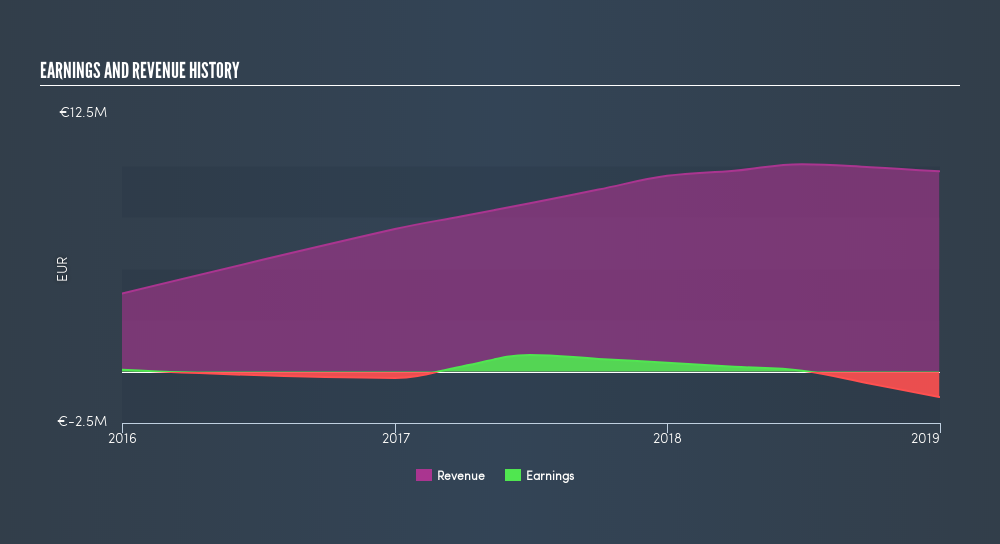

Because Alfio Bardolla Training Group is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Alfio Bardolla Training Group increased its revenue by 2.3%. While that may seem decent it isn't great considering the company is still making a loss. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 50% in a year. In a hot market it's easy to forget growth is the life-blood of a loss making company. So remember, if you buy a profitless company then you risk being a profitless investor.

If you are thinking of buying or selling Alfio Bardolla Training Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While Alfio Bardolla Training Group shareholders are down 50% for the year (even including dividends), the market itself is up 2.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 12% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:ABTG

Alfio Bardolla Training Group

Provides personal finance training services in Italy and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives