- Hong Kong

- /

- Transportation

- /

- SEHK:77

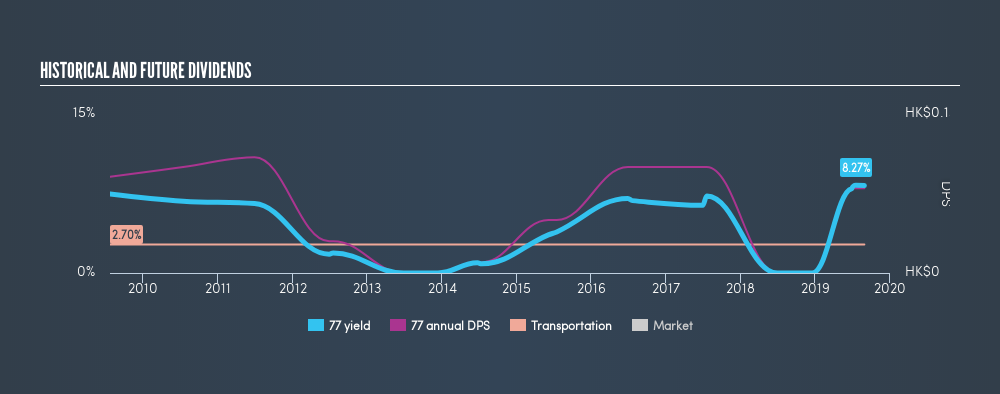

Interested In AMS Public Transport Holdings Limited (HKG:77)’s Upcoming 8.2% Dividend? You Have 4 Days Left

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that AMS Public Transport Holdings Limited (HKG:77) is about to go ex-dividend in just 4 days. Ex-dividend means that investors that purchase the stock on or after the 2nd of September will not receive this dividend, which will be paid on the 11th of September.

AMS Public Transport Holdings's next dividend payment will be HK$0.08 per share. Last year, in total, the company distributed HK$0.08 to shareholders. Looking at the last 12 months of distributions, AMS Public Transport Holdings has a trailing yield of approximately 8.2% on its current stock price of HK$0.97. If you buy this business for its dividend, you should have an idea of whether AMS Public Transport Holdings's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for AMS Public Transport Holdings

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable.

Click here to see how much of its profit AMS Public Transport Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. AMS Public Transport Holdings was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last 5 years, making us wonder if the dividend is sustainable at all.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. AMS Public Transport Holdings has seen its dividend decline 1.3% per annum on average over the past 10 years, which is not great to see.

Remember, you can always get a snapshot of AMS Public Transport Holdings's financial health, by checking our visualisation of its financial health, here.

To Sum It Up

From a dividend perspective, should investors buy or avoid AMS Public Transport Holdings? First, it's not great to see the company paying a dividend despite being loss-making over the last year. On the plus side, the dividend was covered by free cash flow. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

Want to learn more about AMS Public Transport Holdings's dividend performance? Check out this visualisation of its historical revenue and earnings growth.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:77

AMS Public Transport Holdings

An investment holding company, provides franchised public light bus (PLB) and residents’ bus transportation services in Hong Kong.

Average dividend payer slight.

Market Insights

Community Narratives