- United States

- /

- Capital Markets

- /

- NYSE:ICE

Intercontinental Exchange (ICE) Expands Mortgage Tech With New End-To-End Loan Integrations

Reviewed by Simply Wall St

Intercontinental Exchange (ICE), with its recent launch of integrated mortgage solutions, saw its share price increase by 10% over the last quarter. This upward move aligns with the broader positive market sentiment, as the S&P 500 reached new highs despite minor retreats. ICE's developments in mortgage technology enhance its product offering, potentially supporting this growth. Meanwhile, the company's strong Q1 earnings, dividend increase, and strategic client partnerships, such as with eRESI Capital, may have added momentum. These elements, along with new financial products like the NYSE Elite Tech 100 Index, highlight ICE's ongoing adaptability in diverse market conditions.

The recent developments mentioned in the introduction, including the integrated mortgage solutions and strategic partnerships, have the potential to significantly influence Intercontinental Exchange's (ICE) growth prospects by expanding its product offerings and diversifying revenue streams. This aligns with the narrative of ICE enhancing operating efficiencies and bolstering recurring revenues through its investments in technology and data services, suggesting a positive trajectory for margin improvement.

Over a longer-term period of five years, ICE's total shareholder return, including share price and dividends, amounted to 102.43%—a considerable achievement. However, over the past year, ICE underperformed against the US Capital Markets industry, which returned 35.9%, highlighting a discrepancy between short-term and long-term performance metrics.

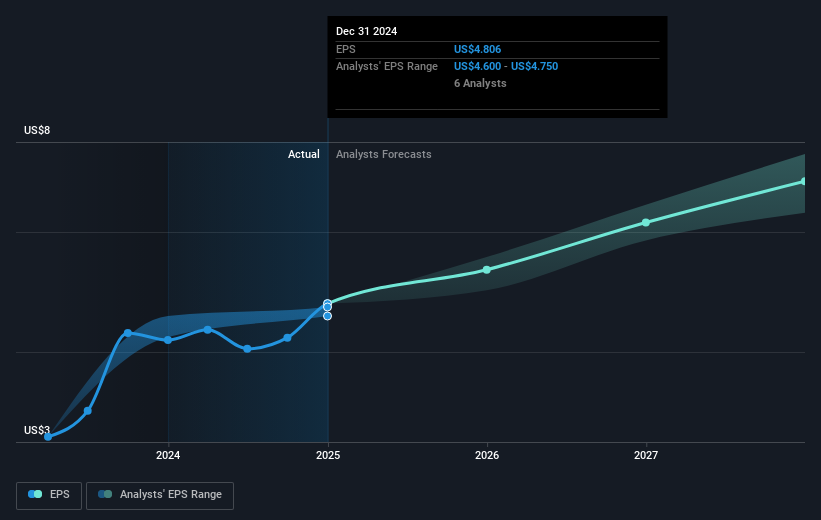

The projected revenue and earnings growth, driven by technology investments and market expansions, could be positively impacted by the recent news, reinforcing analysts' assumptions of annual revenue growth of 5.9% over the next three years. With the current share price at US$182.79, the movement remains below the consensus price target of US$201.625, suggesting room for potential growth should the company meet or exceed these forecasted earnings and revenue benchmarks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives