- United States

- /

- Biotech

- /

- NasdaqGS:INSM

Insmed (INSM) Reports Increased Losses But Reiterates 2025 Revenue Guidance

Reviewed by Simply Wall St

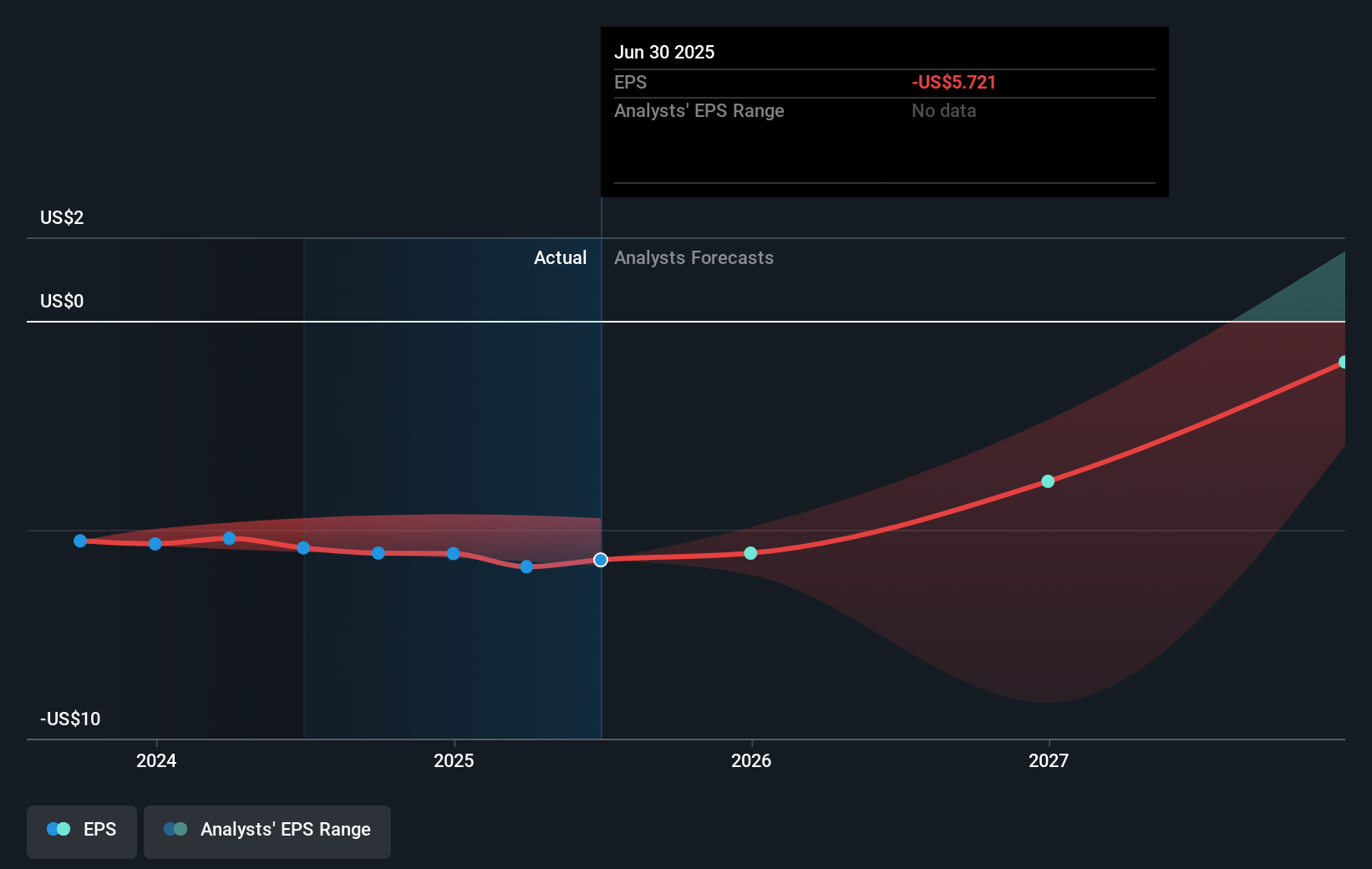

Insmed (INSM) recently reported a net loss of $322 million for the second quarter of 2025, yet despite this, its shares surged by nearly 68% over the past quarter. Key factors include Insmed's confirmed guidance for Global ARIKAYCE revenue growth, potentially reflecting investor confidence in future prospects. Additionally, the company's inclusion in multiple Russell indices may have enhanced market visibility and liquidity. Meanwhile, broader market conditions showed significant weekly gains, with major indices rebounding to record highs, which may have generally supported stock performances, including Insmed's, despite its fiscal losses.

You should learn about the 2 warning signs we've spotted with Insmed.

Despite Insmed's recent net loss, a significant share price surge of nearly 68% over the past quarter suggests robust investor confidence in its future prospects, driven by confirmed guidance for Global ARIKAYCE revenue. Over a longer-term horizon of three years, Insmed's total return, including share price and dividends, surged by 308.60%. This substantial growth indicates a strong investor response to the company's pipeline developments and market strategies. Comparatively, Insmed outperformed both the broader US Market and the biotech industry over the past year, where the US Market returned 22.4% and the industry saw a 6.5% decline.

The recent news and share price movements could influence Insmed's revenue and earnings forecasts. The upcoming launch of brensocatib in the U.S., combined with the favorable market response to ARIKAYCE, may bolster revenue projections, despite current earnings challenges. With analysts estimating a fair value price target of US$117.29, the current share price of US$109.30 suggests a slight discount. This indicates that investors might see potential in Insmed aligning closely with expected future earnings growth.

Dive into the specifics of Insmed here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INSM

Insmed

Develops and commercializes therapies for patients with serious and rare diseases in the United States, Europe, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives