- Hong Kong

- /

- Healthcare Services

- /

- SEHK:2666

Industry Analysts Just Upgraded Their Genertec Universal Medical Group Company Limited (HKG:2666) Revenue Forecasts By 17%

Genertec Universal Medical Group Company Limited (HKG:2666) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline. The market seems to be pricing in some improvement in the business too, with the stock up 8.2% over the past week, closing at CN¥4.75. Could this big upgrade push the stock even higher?

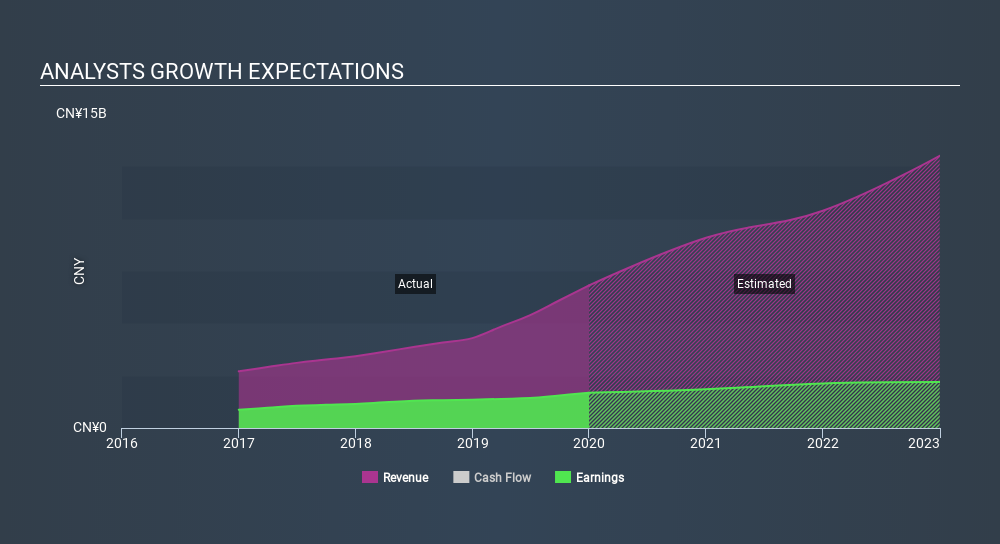

Following the upgrade, the latest consensus from Genertec Universal Medical Group's three analysts is for revenues of CN¥9.1b in 2020, which would reflect a major 33% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to accumulate 8.3% to CN¥1.06. Previously, the analysts had been modelling revenues of CN¥7.8b and earnings per share (EPS) of CN¥1.07 in 2020. It seems analyst sentiment has certainly become more bullish on revenues, even though they haven't changed their view on earnings per share.

See our latest analysis for Genertec Universal Medical Group

It may not be a surprise to see that the analysts have reconfirmed their price target of CN¥6.76, implying that the uplift in sales is not expected to greatly contribute to Genertec Universal Medical Group's valuation in the near term. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Genertec Universal Medical Group at CN¥7.77 per share, while the most bearish prices it at CN¥6.24. Still, with such a tight range of estimates, it suggests the analysts have a pretty good idea of what they think the company is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Genertec Universal Medical Group's past performance and to peers in the same industry. The analysts are definitely expecting Genertec Universal Medical Group's growth to accelerate, with the forecast 33% growth ranking favourably alongside historical growth of 26% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 15% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Genertec Universal Medical Group to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with analysts reconfirming that earnings per share are expected to continue performing in line with their prior expectations. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Genertec Universal Medical Group.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:2666

Genertec Universal Medical Group

Provides financing, advisory, and medical services in the People’s Republic of China.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives