- United States

- /

- Food

- /

- NYSE:SJM

Income Investors Should Know That The J. M. Smucker Company (NYSE:SJM) Goes Ex-Dividend Soon

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see The J. M. Smucker Company (NYSE:SJM) is about to trade ex-dividend in the next 4 days. Ex-dividend means that investors that purchase the stock on or after the 15th of August will not receive this dividend, which will be paid on the 3rd of September.

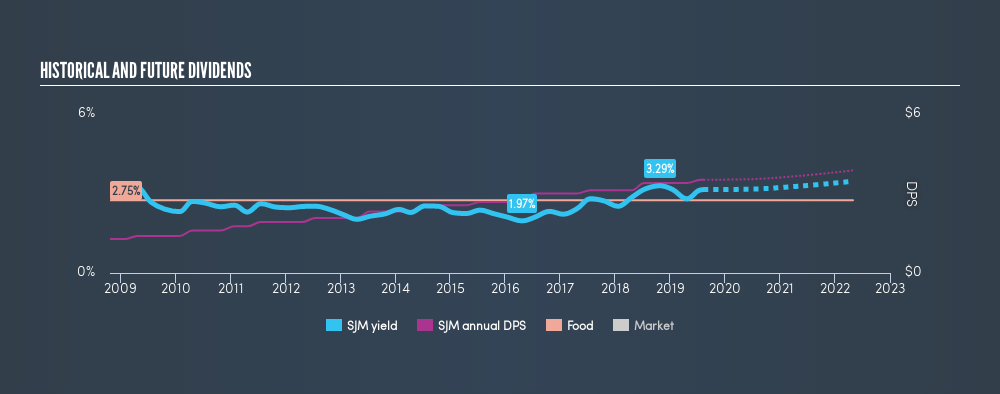

J. M. Smucker's next dividend payment will be US$0.88 per share, and in the last 12 months, the company paid a total of US$3.40 per share. Last year's total dividend payments show that J. M. Smucker has a trailing yield of 3.1% on the current share price of $111.84. If you buy this business for its dividend, you should have an idea of whether J. M. Smucker's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for J. M. Smucker

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Its dividend payout ratio is 75% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth It could become a concern if earnings started to decline. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It distributed 48% of its free cash flow as dividends, a comfortable payout level for most companies.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's not ideal to see J. M. Smucker's earnings per share have been shrinking at 3.6% a year over the previous five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last 10 years, J. M. Smucker has lifted its dividend by approximately 11% a year on average. Growing the dividend payout ratio while earnings are declining can deliver nice returns for a while, but it's always worth checking for when the company can't increase the payout ratio any more - because then the music stops.

Final Takeaway

Is J. M. Smucker an attractive dividend stock, or better left on the shelf? The payout ratios are within a reasonable range, implying the dividend may be sustainable. Declining earnings are a serious concern, however, and could pose a threat to the dividend in future. Overall, it's not a bad combination, but we feel that there are likely more attractive dividend prospects out there.

Wondering what the future holds for J. M. Smucker? See what the 14 analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives