- United States

- /

- Biotech

- /

- NasdaqCM:SURF

Imagine Owning Surface Oncology (NASDAQ:SURF) And Wondering If The 32% Share Price Slide Is Justified

This month, we saw the Surface Oncology, Inc. (NASDAQ:SURF) up an impressive 63%. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 32% in one year, under-performing the market.

View our latest analysis for Surface Oncology

Given that Surface Oncology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year Surface Oncology saw its revenue fall by 74%. That looks like a train-wreck result to investors far and wide. Meanwhile, the share price dropped by 32%. It's always work digging deeper, but we'd probably need to see a strong balance sheet and bottom line improvements to get interested in this one.

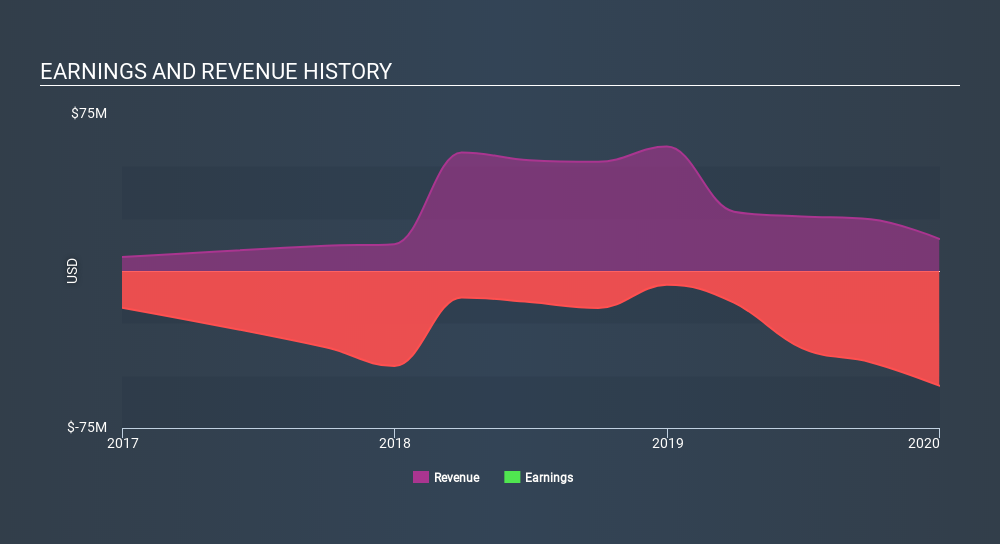

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Surface Oncology shareholders are down 32% for the year, even worse than the market loss of 0.8%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 16% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Surface Oncology has 5 warning signs (and 1 which is potentially serious) we think you should know about.

But note: Surface Oncology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:SURF

Surface Oncology

Surface Oncology, Inc., a clinical-stage immuno-oncology company, engages in the development of cancer therapies in the United States.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives