Imagine Owning San Miguel Brewery Hong Kong (HKG:236) And Wondering If The 28% Share Price Slide Is Justified

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in San Miguel Brewery Hong Kong Limited (HKG:236), since the last five years saw the share price fall 28%. The good news is that the stock is up 4.0% in the last week.

Check out our latest analysis for San Miguel Brewery Hong Kong

Given that San Miguel Brewery Hong Kong didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade San Miguel Brewery Hong Kong reduced its trailing twelve month revenue by 4.5% for each year. That's not what investors generally want to see. The share price decline at a rate of 6.3% per year is disappointing. But it doesn't surprise given the falling revenue. Without profits, its hard to see how shareholders win if the revenue keeps falling.

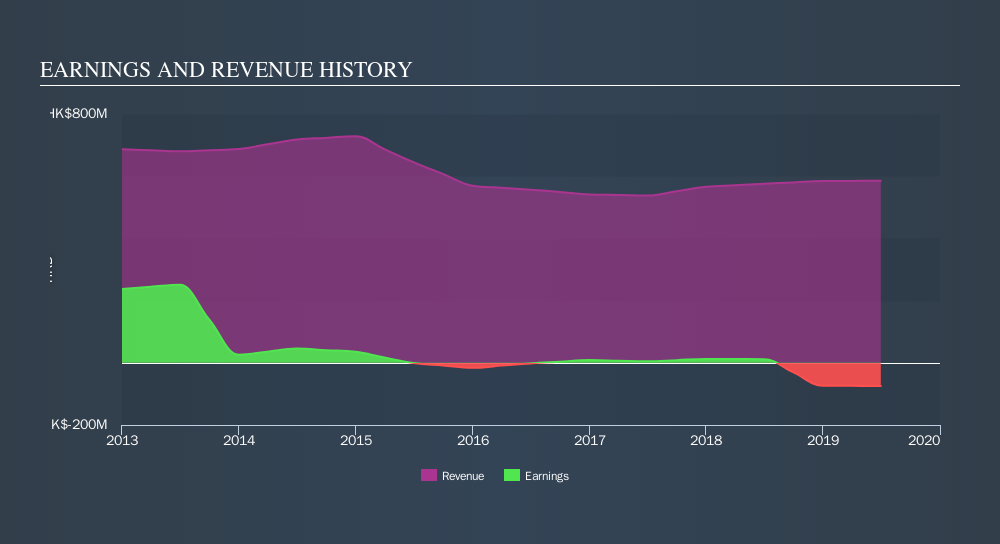

You can see below how earnings and revenue have changed over time.

This free interactive report on San Miguel Brewery Hong Kong's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 6.8% in the last year, San Miguel Brewery Hong Kong shareholders lost 4.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 6.1% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course San Miguel Brewery Hong Kong may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:236

San Miguel Brewery Hong Kong

Manufactures and distributes bottled, canned, and draught beers in Hong Kong, Mainland China, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives