- India

- /

- Energy Services

- /

- NSEI:OILCOUNTUB

Imagine Owning Oil Country Tubular (NSE:OILCOUNTUB) And Trying To Stomach The 89% Share Price Drop

It is a pleasure to report that the Oil Country Tubular Limited (NSE:OILCOUNTUB) is up 78% in the last quarter. But only the myopic could ignore the astounding decline over three years. In that time the share price has melted like a snowball in the desert, down 89%. So it's about time shareholders saw some gains. But the more important question is whether the underlying business can justify a higher price still.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Oil Country Tubular

With just ₹129,518,000 worth of revenue in twelve months, we don't think the market considers Oil Country Tubular to have proven its business plan. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Oil Country Tubular finds fossil fuels with an exploration program, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Oil Country Tubular investors have already had a taste of the bitterness stocks like this can leave in the mouth.

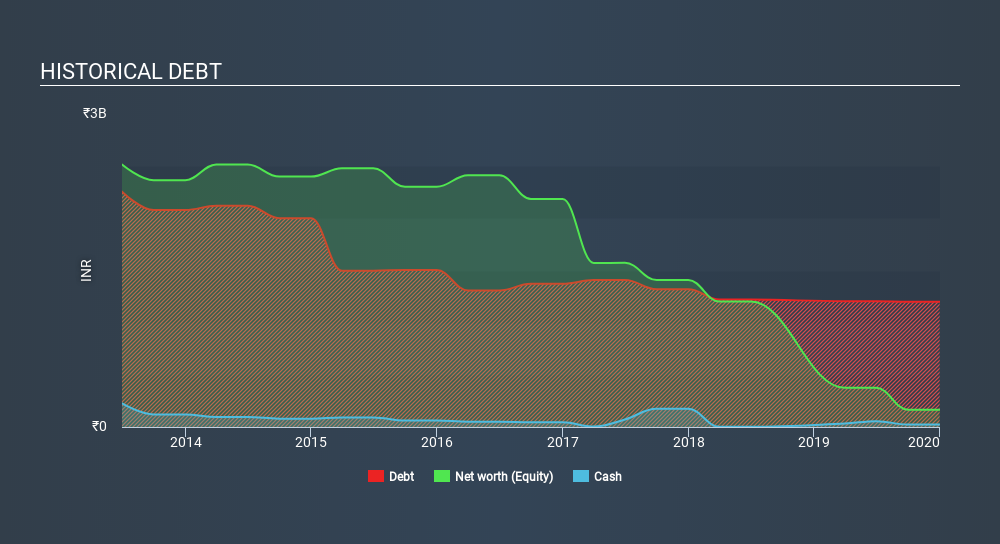

Oil Country Tubular had liabilities exceeding cash by ₹2.2b when it last reported in December 2019, according to our data. That puts it in the highest risk category, according to our analysis. But since the share price has dived 52% per year, over 3 years , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Oil Country Tubular's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

While the broader market lost about 13% in the twelve months, Oil Country Tubular shareholders did even worse, losing 24%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 29% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Oil Country Tubular is showing 5 warning signs in our investment analysis , and 3 of those can't be ignored...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:OILCOUNTUB

Oil Country Tubular

Manufactures and sells casing, tubing, and drill pipes used in the oil and gas drilling and exploration sector in India and internationally.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives