- United States

- /

- Hospitality

- /

- NasdaqGS:JACK

Imagine Owning Jack in the Box (NASDAQ:JACK) And Wondering If The 23% Share Price Slide Is Justified

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Jack in the Box Inc. (NASDAQ:JACK) shareholders, since the share price is down 23% in the last three years, falling well short of the market return of around 50%. The good news is that the stock is up 1.3% in the last week.

View our latest analysis for Jack in the Box

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, Jack in the Box actually managed to grow EPS by 4.0% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. But it's possible a look at other metrics will be enlightening.

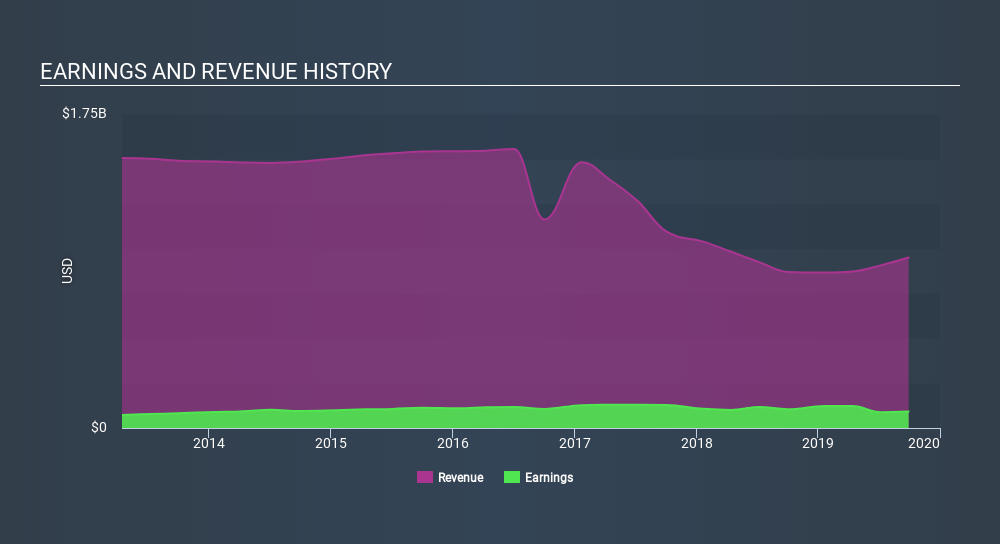

The modest 1.9% dividend yield is unlikely to be guiding the market view of the stock. Arguably the revenue decline of 17% per year has people thinking Jack in the Box is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Jack in the Box is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Jack in the Box will earn in the future (free analyst consensus estimates)

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Jack in the Box the TSR over the last 3 years was -19%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Jack in the Box shareholders gained a total return of 4.1% during the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 0.8% over half a decade It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand Jack in the Box better, we need to consider many other factors. Be aware that Jack in the Box is showing 3 warning signs in our investment analysis , and 1 of those is potentially serious...

But note: Jack in the Box may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:JACK

Jack in the Box

Operates and franchises quick-service restaurants under the Jack in the Box and Del Taco brands in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives