- United States

- /

- Pharma

- /

- OTCPK:ENDP.Q

Imagine Owning Endo International (NASDAQ:ENDP) And Trying To Stomach The 93% Share Price Drop

It is doubtless a positive to see that the Endo International plc (NASDAQ:ENDP) share price has gained some 53% in the last three months. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Like a ship taking on water, the share price has sunk 93% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The million dollar question is whether the company can justify a long term recovery.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View 1 warning sign we detected for Endo International

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

We know that Endo International has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

Revenue is actually up 2.0% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

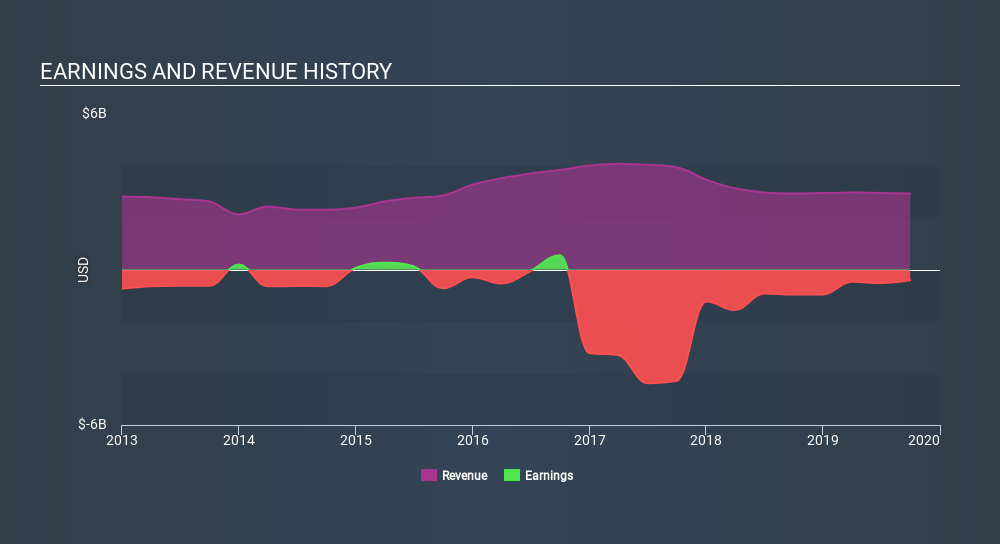

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

While the share price may move with revenue, other factors can also play a role. For example, we've discovered 1 warning sign for Endo International which any shareholder or potential investor should be aware of.

A Different Perspective

Investors in Endo International had a tough year, with a total loss of 34%, against a market gain of about 40%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 42% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:ENDP.Q

Endo International

A specialty pharmaceutical company, develops, manufactures, markets, and sells various pharmaceutical products in the United States and internationally.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives