Imagine Owning El Al Israel Airlines (TLV:ELAL) While The Price Tanked 70%

If you love investing in stocks you're bound to buy some losers. But long term El Al Israel Airlines Ltd (TLV:ELAL) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 70% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 21% lower in that time. Shareholders have had an even rougher run lately, with the share price down 38% in the last 90 days.

Check out our latest analysis for El Al Israel Airlines

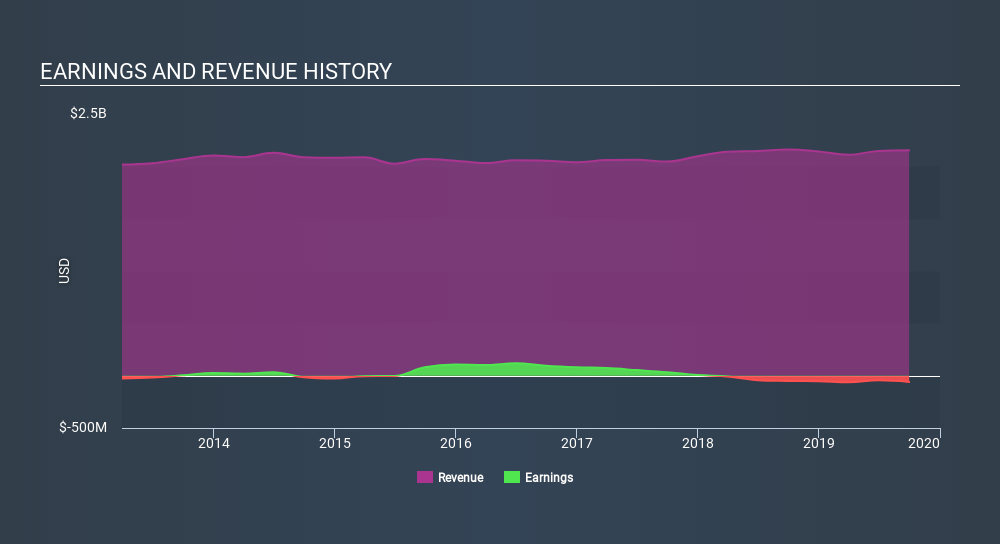

Given that El Al Israel Airlines didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, El Al Israel Airlines grew revenue at 1.9% per year. That's not a very high growth rate considering it doesn't make profits. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 33% during the period. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on El Al Israel Airlines's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered El Al Israel Airlines's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. El Al Israel Airlines's TSR of was a loss of 69% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 22% in the last year, El Al Israel Airlines shareholders lost 21%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for El Al Israel Airlines (1 is a bit unpleasant) that you should be aware of.

We will like El Al Israel Airlines better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TASE:ELAL

El Al Israel Airlines

Provides passenger and cargo transportation services.

Solid track record and good value.

Market Insights

Community Narratives