- France

- /

- Aerospace & Defense

- /

- ENXTPA:ALTD

Imagine Owning Delta Drone (EPA:ALDR) And Taking A 98% Loss Square On The Chin

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. Imagine if you held Delta Drone SA (EPA:ALDR) for half a decade as the share price tanked 98%. And some of the more recent buyers are probably worried, too, with the stock falling 69% in the last year. On the other hand the share price has bounced 8.5% over the last week.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Delta Drone

Given that Delta Drone didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

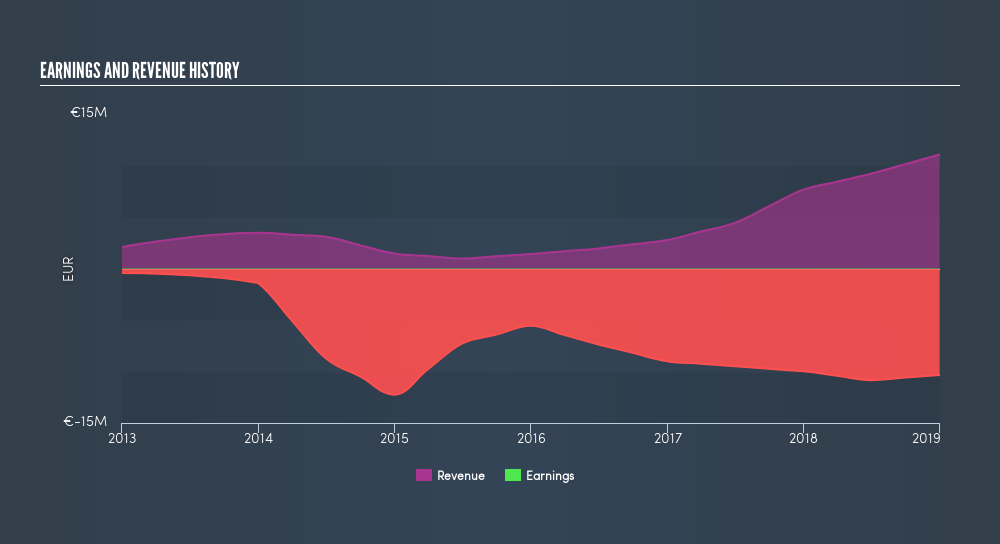

In the last half decade, Delta Drone saw its revenue increase by 39% per year. That's well above most other pre-profit companies. So it's not at all clear to us why the share price sunk 53% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

Take a more thorough look at Delta Drone's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Delta Drone had a tough year, with a total loss of 69%, against a market gain of about 5.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 53% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Delta Drone better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:ALTD

Tonner Drones

Develops drones and drone-related technology for the military and homeland security sectors.

Slight with weak fundamentals.

Market Insights

Community Narratives