- Canada

- /

- Oil and Gas

- /

- TSX:VRN

Imagine Owning Crescent Point Energy (TSE:CPG) And Trying To Stomach The 82% Share Price Drop

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Crescent Point Energy Corp. (TSE:CPG) during the five years that saw its share price drop a whopping 82%. On top of that, the share price is down 7.6% in the last week.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Crescent Point Energy

Crescent Point Energy wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Crescent Point Energy saw its revenue increase by 2.3% per year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 29%, compound, over five years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. A company like this generally needs to produce profits before it can find favour with new investors.

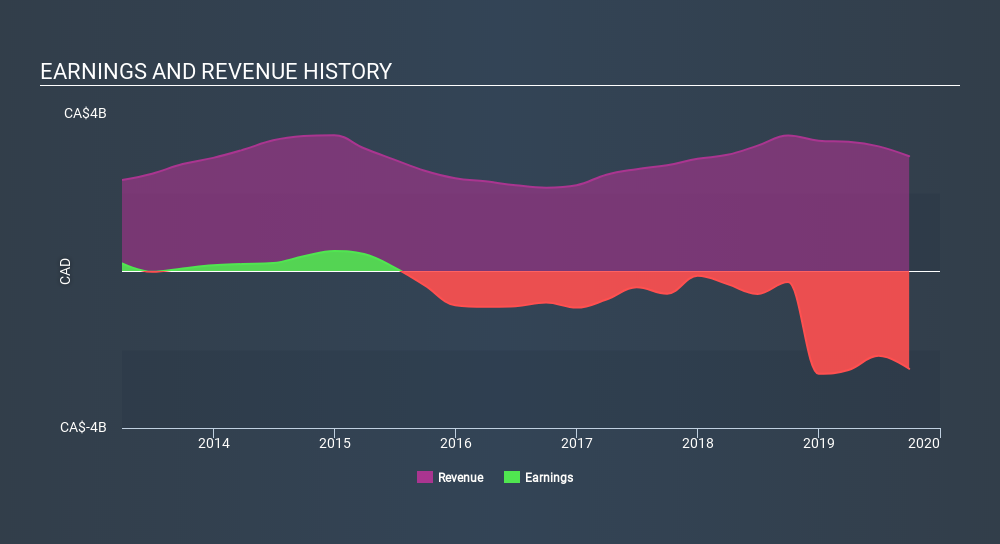

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Crescent Point Energy stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Crescent Point Energy the TSR over the last 5 years was -78%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Crescent Point Energy shareholders have received a total shareholder return of 19% over the last year. And that does include the dividend. Notably the five-year annualised TSR loss of 26% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:VRN

Veren

Engages in acquiring, developing, and holding interests in petroleum assets operations across western Canada.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives