Imagine Owning Attica Bank (ATH:TATT) And Taking A 99% Loss Square On The Chin

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held Attica Bank S.A. (ATH:TATT) for five whole years - as the share price tanked 99%. Shareholders have had an even rougher run lately, with the share price down 58% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 42% in the same timeframe.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Attica Bank

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

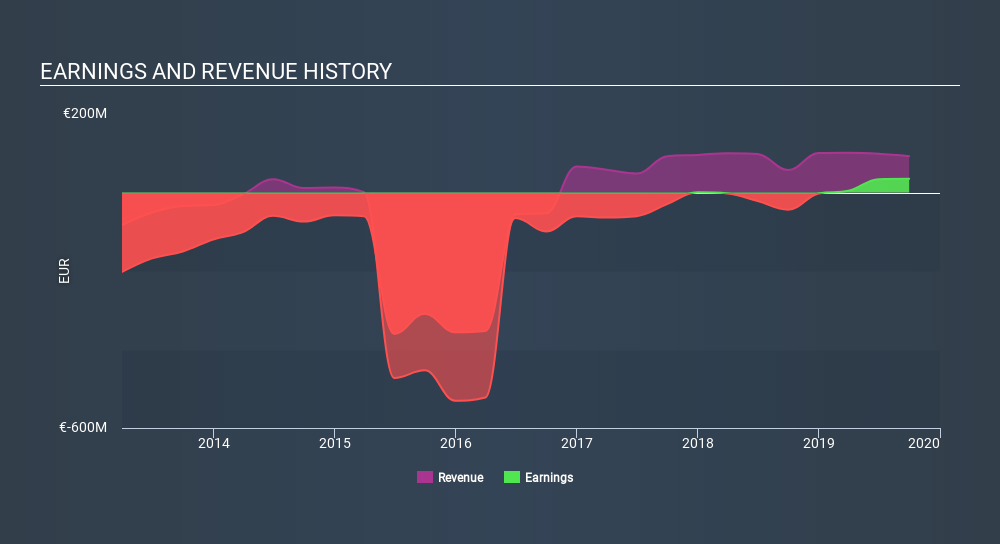

During five years of share price growth, Attica Bank moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

In contrast to the share price, revenue has actually increased by 55% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Attica Bank has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While it's never nice to take a loss, Attica Bank shareholders can take comfort that their trailing twelve month loss of 2.9% wasn't as bad as the market loss of around 24%. What is more upsetting is the 60% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. It's always interesting to track share price performance over the longer term. But to understand Attica Bank better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Attica Bank you should know about.

Of course Attica Bank may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ATSE:TATT

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives