If You Had Bought Xeris Pharmaceuticals (NASDAQ:XERS) Stock A Year Ago, You'd Be Sitting On A 57% Loss, Today

Investing in stocks comes with the risk that the share price will fall. Anyone who held Xeris Pharmaceuticals, Inc. (NASDAQ:XERS) over the last year knows what a loser feels like. The share price has slid 57% in that time. Xeris Pharmaceuticals hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. It's down 3.6% in the last seven days.

View our latest analysis for Xeris Pharmaceuticals

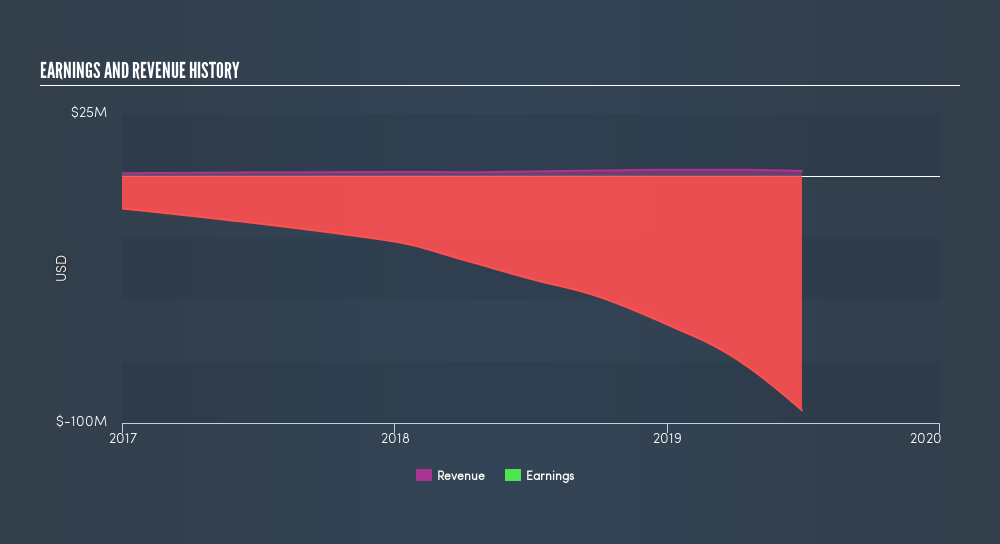

Because Xeris Pharmaceuticals is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Xeris Pharmaceuticals saw its revenue grow by 13%. While that may seem decent it isn't great considering the company is still making a loss. It's likely this muted growth has contributed to the share price decline of 57% in the last year. We'd want to see evidence that future revenue growth will be stronger before getting too interested. Of course, the market can be too impatient at times. Why not take a closer look at this one so you're ready to pounce if growth does accelerate.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Xeris Pharmaceuticals will earn in the future (free profit forecasts).

A Different Perspective

Xeris Pharmaceuticals shareholders are down 57% for the year, even worse than the market loss of 0.5%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 2.9%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Xeris Pharmaceuticals by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives