- France

- /

- Semiconductors

- /

- ENXTPA:XFAB

If You Had Bought X-FAB Silicon Foundries (EPA:XFAB) Stock A Year Ago, You'd Be Sitting On A 22% Loss, Today

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the X-FAB Silicon Foundries SE (EPA:XFAB) share price slid 22% over twelve months. That's disappointing when you consider the market returned 20%. X-FAB Silicon Foundries may have better days ahead, of course; we've only looked at a one year period. It's down 1.6% in the last seven days.

See our latest analysis for X-FAB Silicon Foundries

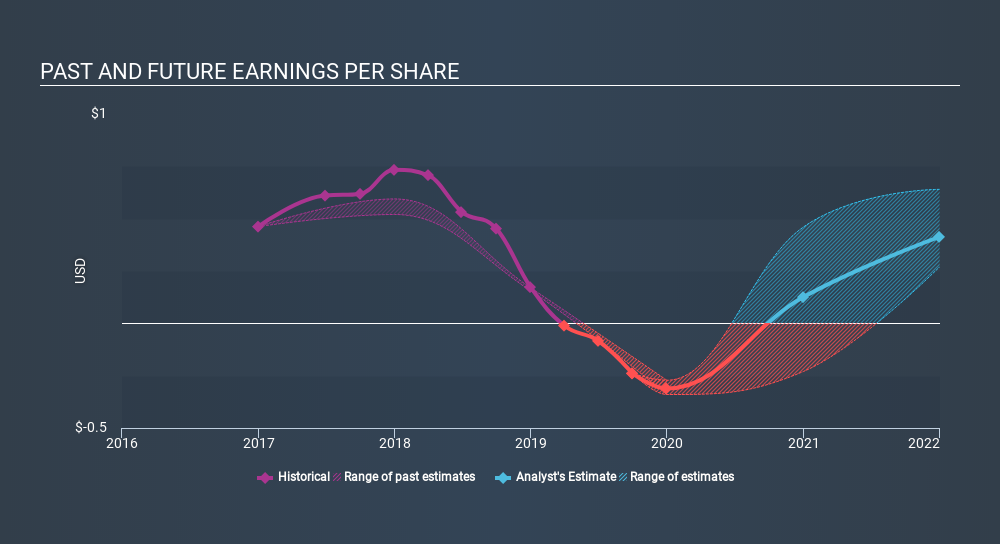

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year X-FAB Silicon Foundries saw its earnings per share drop below zero. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. However, there may be an opportunity for investors if the company can recover.

You can see below how EPS has changed over time.

This free interactive report on X-FAB Silicon Foundries's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 20% in the last year, X-FAB Silicon Foundries shareholders might be miffed that they lost 22%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 1.3%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like X-FAB Silicon Foundries better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:XFAB

X-FAB Silicon Foundries

Develops, produces, and sells analog/mixed-signal IC, micro-electro-mechanical systems, and silicon carbide products for automotive, medical, industrial, communication, and consumer sectors in the Europe, the United States, Asia, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives