- Canada

- /

- Construction

- /

- TSX:WSP

If You Had Bought WSP Global (TSE:WSP) Shares Five Years Ago You'd Have Made 110%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. For instance, the price of WSP Global Inc. (TSE:WSP) stock is up an impressive 110% over the last five years. We note the stock price is up 1.5% in the last seven days.

See our latest analysis for WSP Global

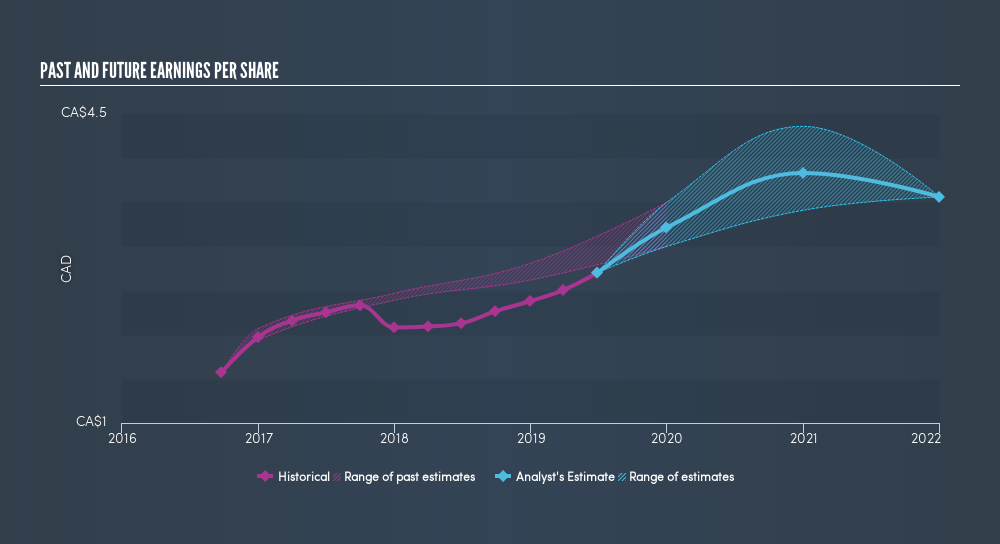

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, WSP Global managed to grow its earnings per share at 13% a year. This EPS growth is lower than the 16% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

We know that WSP Global has improved its bottom line lately, but is it going to grow revenue? Check if analysts think WSP Global will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, WSP Global's TSR for the last 5 years was 146%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that WSP Global shareholders have received a total shareholder return of 5.1% over the last year. And that does include the dividend. However, that falls short of the 20% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Before forming an opinion on WSP Global you might want to consider these 3 valuation metrics.

But note: WSP Global may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:WSP

WSP Global

Operates as a professional services consulting firm in the United States, Canada, the United Kingdom, Sweden, Australia, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives