If You Had Bought Troax Group (STO:TROAX) Shares Three Years Ago You'd Have Made 121%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. For example, the Troax Group AB (publ) (STO:TROAX) share price has soared 121% in the last three years. How nice for those who held the stock! In more good news, the share price has risen 2.6% in thirty days. We note that Troax Group reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report.

See our latest analysis for Troax Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

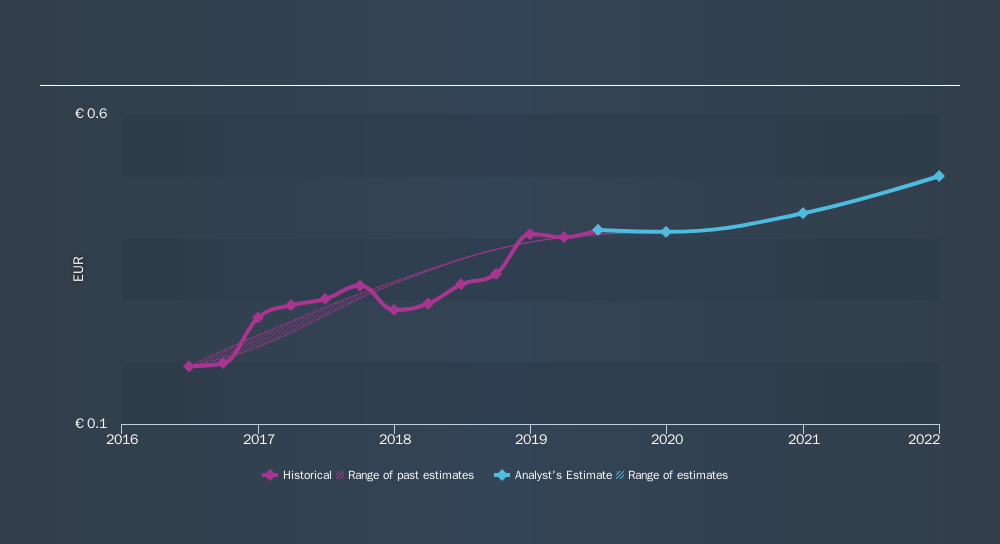

Troax Group was able to grow its EPS at 29% per year over three years, sending the share price higher. Notably, the 30% average annual share price gain matches up nicely with the EPS growth rate. This observation indicates that the market's attitude to the business hasn't changed all that much. Rather, the share price has approximately tracked EPS growth.

We know that Troax Group has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Troax Group's TSR for the last 3 years was 131%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Over the last year Troax Group shareholders have received a TSR of 3.6%. It's always nice to make money but this return falls short of the market return which was about 5.9% for the year. At least the longer term returns (running at about 32% a year, are better. Even the best companies don't see strong share price performance every year. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Troax Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OM:TROAX

Troax Group

Through its subsidiaries, produces and sells mesh panels in the Nordic region, the United Kingdom, North America, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives