If You Had Bought Sree Rayalaseema Hi-Strength Hypo (NSE:SRHHYPOLTD) Stock Five Years Ago, You Could Pocket A 161% Gain Today

Sree Rayalaseema Hi-Strength Hypo Limited (NSE:SRHHYPOLTD) shareholders might be concerned after seeing the share price drop 10% in the last week. But that scarcely detracts from the really solid long term returns generated by the company over five years. It's fair to say most would be happy with 161% the gain in that time. To some, the recent pullback wouldn't be surprising after such a fast rise. The more important question is whether the stock is too cheap or too expensive today. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 27% drop, in the last year.

See our latest analysis for Sree Rayalaseema Hi-Strength Hypo

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

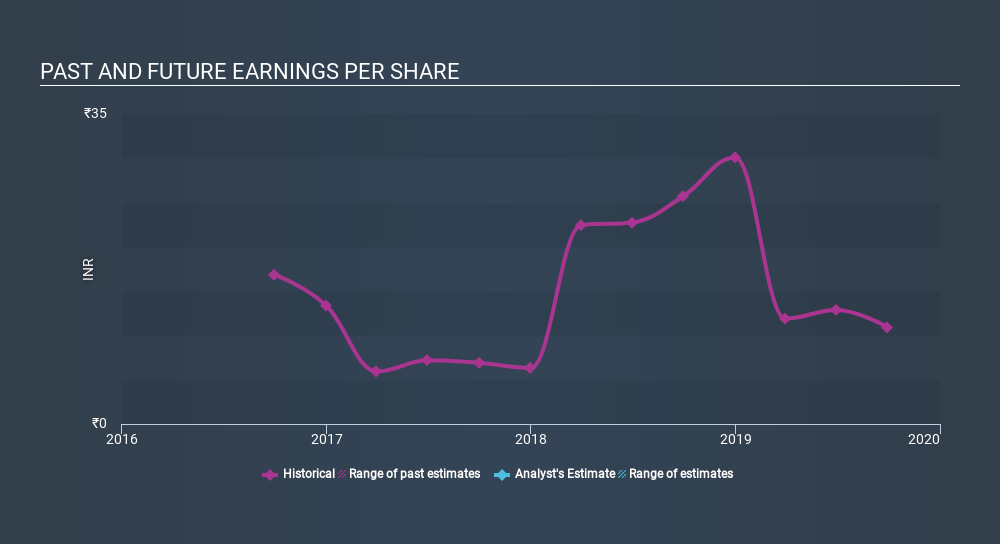

During five years of share price growth, Sree Rayalaseema Hi-Strength Hypo achieved compound earnings per share (EPS) growth of 2.3% per year. This EPS growth is slower than the share price growth of 21% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Sree Rayalaseema Hi-Strength Hypo's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Sree Rayalaseema Hi-Strength Hypo's TSR for the last 5 years was 183%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Sree Rayalaseema Hi-Strength Hypo shareholders are down 26% for the year (even including dividends) , but the market itself is up 6.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 23%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Sree Rayalaseema Hi-Strength Hypo you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:SRHHYPOLTD

Sree Rayalaseema Hi-Strength Hypo

Produces and sells industrial chemicals in India.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives