- United States

- /

- Semiconductors

- /

- NYSE:SQNS

If You Had Bought Sequans Communications (NYSE:SQNS) Stock Three Years Ago, You'd Be Sitting On A 76% Loss, Today

It's not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Sequans Communications S.A. (NYSE:SQNS), who have seen the share price tank a massive 76% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The more recent news is of little comfort, with the share price down 52% in a year. Shareholders have had an even rougher run lately, with the share price down 49% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

View our latest analysis for Sequans Communications

Given that Sequans Communications didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Sequans Communications saw its revenue shrink by 13% per year. That's not what investors generally want to see. The share price fall of 38% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. This business clearly needs to grow revenues if it is to perform as investors hope. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

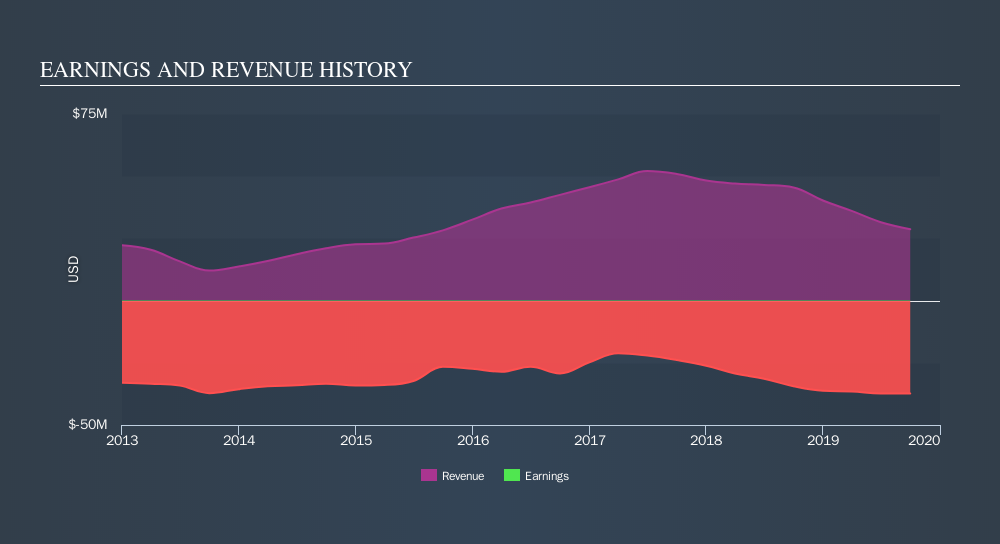

The company's revenue and earnings (over time) are depicted in the image below.

This free interactive report on Sequans Communications's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Sequans Communications shareholders are down 52% for the year, but the market itself is up 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 19% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You could get a better understanding of Sequans Communications's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Sequans Communications may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:SQNS

Sequans Communications

Engages in the fabless designing, developing, and supplying of cellular semiconductor solutions for massive and broadband internet of things markets.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives