- India

- /

- Diversified Financial

- /

- NSEI:PFC

If You Had Bought Power Finance (NSE:PFC) Stock Three Years Ago, You'd Be Sitting On A 45% Loss, Today

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Power Finance Corporation Limited (NSE:PFC) shareholders, since the share price is down 45% in the last three years, falling well short of the market return of around -16%. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 26% in the same timeframe.

View our latest analysis for Power Finance

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Although the share price is down over three years, Power Finance actually managed to grow EPS by 62% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that the dividend has declined - a likely contributor to the share price drop. It doesn't seem like the changes in revenue would have impacted the share price much, but a closer inspection of the data might reveal something.

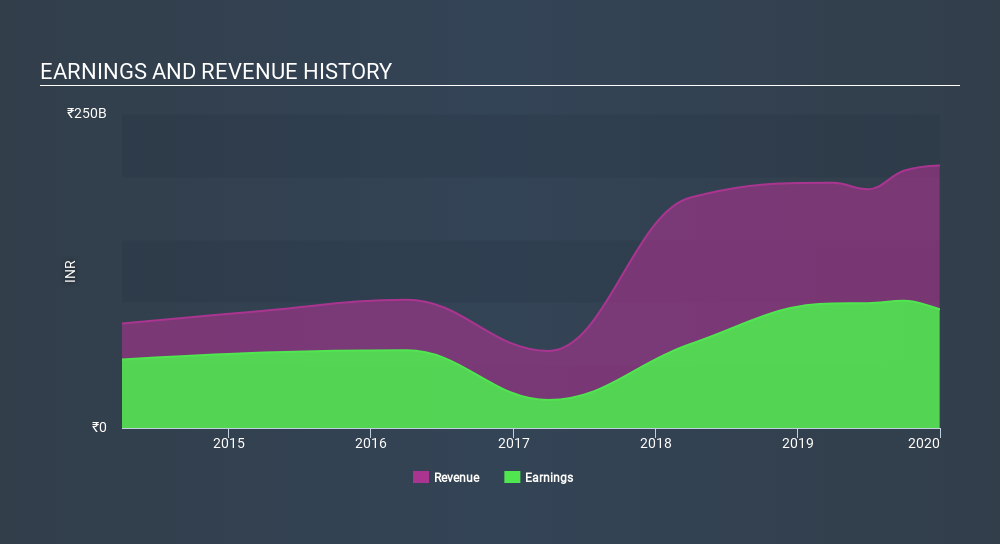

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Power Finance's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Power Finance the TSR over the last 3 years was -37%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Although it hurts that Power Finance returned a loss of 20% in the last twelve months, the broader market was actually worse, returning a loss of 26%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 4.3% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Power Finance better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Power Finance you should be aware of, and 1 of them doesn't sit too well with us.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:PFC

Power Finance

A non-banking finance company, provides financial products and related advisory, and other services to the power sector in India.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives